Your Child tax credit 2021 paid monthly images are available in this site. Child tax credit 2021 paid monthly are a topic that is being searched for and liked by netizens now. You can Download the Child tax credit 2021 paid monthly files here. Download all free photos.

If you’re looking for child tax credit 2021 paid monthly pictures information connected with to the child tax credit 2021 paid monthly keyword, you have visit the right blog. Our website always gives you suggestions for refferencing the maximum quality video and picture content, please kindly hunt and locate more informative video articles and images that match your interests.

Child Tax Credit 2021 Paid Monthly. The final credit was delivered in December. That can come in monthly payments 250 per. The Internal Revenue Service began sending letters to recipients. In 2021 parents could receive an advance of half of their child tax credit in monthly payments.

What To Know About The First Advance Child Tax Credit Payment From cnbc.com

What To Know About The First Advance Child Tax Credit Payment From cnbc.com

Received monthly payments in 2021 as part of the expanded Child Tax Credit program and with tax season coming up there is some important information to know and look out for in 2022. FAMILIES have grown used to monthly 300 payments through the expanded child tax credit but in February 2022 theres a chance the long-awaited extension could double payments. The 2021 advance monthly child tax credit payments started automatically in July. Residents may receive half of the child tax credit for tax year 2021 for each qualifying child in equal payments from september to. In 2021 parents could receive an advance of half of their child tax credit in monthly payments. You claim the other half when you file your 2021 income tax return.

FAMILIES have grown used to monthly 300 payments through the expanded child tax credit but in February 2022 theres a chance the long-awaited extension could double payments.

Those with co-dependents. For 2021 the credit increases to 3000 from 2000 per child under the age of 17 and gives an additional 600 benefit for children under the age of 6. Even though child tax credit payments are scheduled to arrive on certain dates you may not have gotten the money. Advance child tax credit update september 27 2021. Reporting by Merdie Nzanga. The big difference in 2021 is that starting in July half of the child tax credit will be paid out via monthly payments of up to 300 per child through the end of the year.

Source: cbsnews.com

Source: cbsnews.com

The credit is 3600 annually for children. The credit was increased to 3000 from 2000 with a 600 bonus for kids under the age of 6 for the 2021 tax year. That can come in monthly payments 250 per. A Blessing and a Relief. Half the total credit amount was paid in advance monthly payments in 2021.

Source: cnbc.com

Source: cnbc.com

That can come in monthly payments 250 per. Residents may receive half of the child tax credit for tax year 2021 for each qualifying child in equal payments from september to. The big difference in 2021 is that starting in July half of the child tax credit will be paid out via monthly payments of up to 300 per child through the end of the year. The final credit was delivered in December. Reporting by Merdie Nzanga.

For the 86 of families using direct deposit they will receive their child payment today July 15 th and the 15 th of every month for the rest of 2021. A Blessing and a Relief. The child tax credit was provided monthly between July 15 and Dec. Parents with co-dependents under the age of 6 were eligible for 3600 or 300 monthly payments. The big difference in 2021 is that starting in July half of the child tax credit will be paid out via monthly payments of up to 300 per child through the end of the year.

Source: marca.com

Source: marca.com

Reporting by Merdie Nzanga. The final credit was delivered in December. The Internal Revenue Service began sending letters to recipients. Normally anyone who receives a payment this month will also receive a payment each month for the rest of 2021 unless they unenroll. 15 but there is still more of that money coming to Americans later this year.

Source: cbpp.org

Source: cbpp.org

Advance payments were sent automatically to eligible people. Residents may receive half of the child tax credit for tax year 2021 for each qualifying child in equal payments from september to. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Additionally a portion of your amount is reduced by 50 for every 1000 over certain income limits see the FAQs below. The credit was increased to 3000 from 2000 with a 600 bonus for kids under the age of 6 for the 2021 tax year. They will receive advance payments of 550 a month a total of 3300 in 2021.

Source: winknews.com

Source: winknews.com

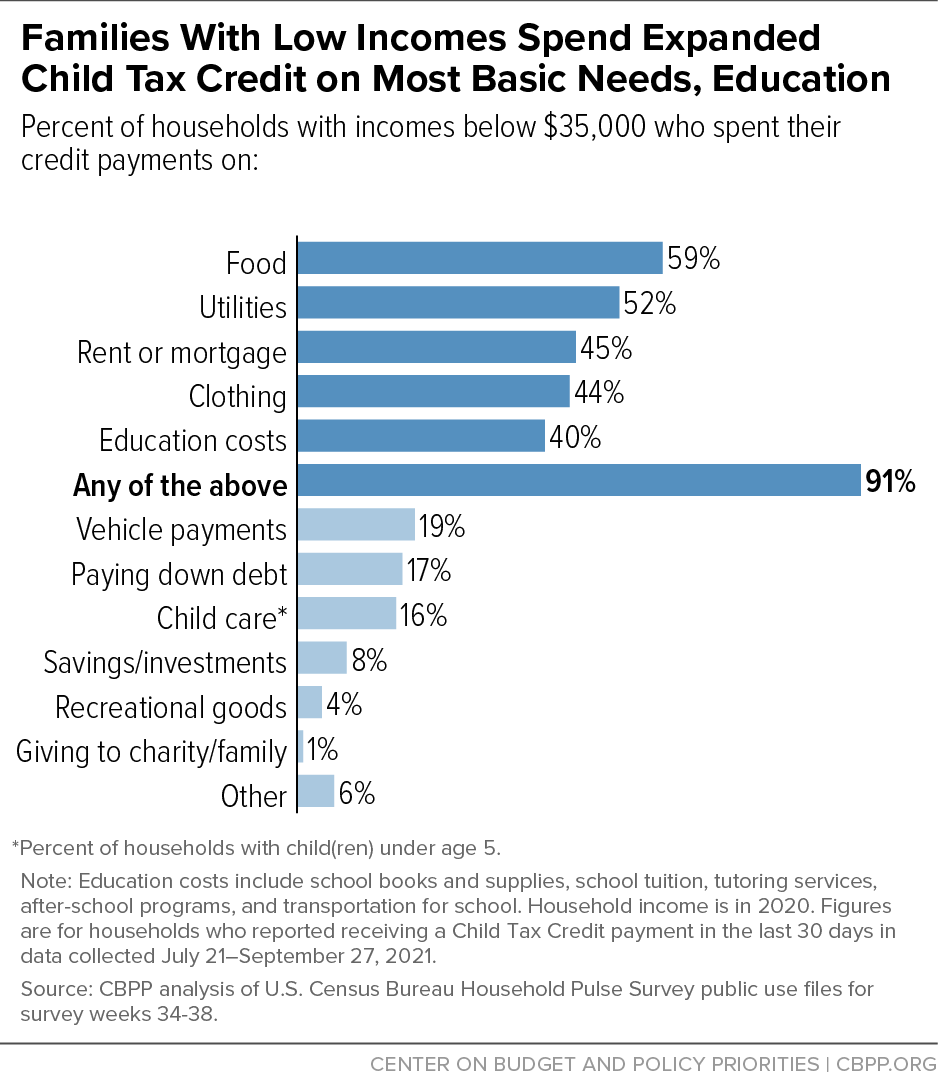

Received monthly payments in 2021 as part of the expanded Child Tax Credit program and with tax season coming up there is some important information to know and look out for in 2022. Editing by John Stonestreet. The final monthly payment of 2021 went out Dec. Parents with co-dependents under the age of 6 were eligible for 3600 or 300 monthly payments. How Four Families Used the Child Tax Credit The monthly payments of up to 300 per child put food on the table paid bills and even went toward the occasional splurge.

The credit was increased to 3000 from 2000 with a 600 bonus for kids under the age of 6 for the 2021 tax year. WASHINGTON - Many parents across the US. The Internal Revenue Service began sending letters to recipients. That can come in monthly payments 250 per. Advance payments were sent automatically to eligible people.

Source: fingerlakes1.com

Source: fingerlakes1.com

While some media outlets have taken to calling them monthly stimulus checks they are more similar though not entirely to whats known as a child allowance or family benefits in other developed countries. The payment for children. Important changes to the Child Tax Credit helped many families get advance payments of the credit. The Internal Revenue Service began sending letters to recipients. Received monthly payments in 2021 as part of the expanded Child Tax Credit program and with tax season coming up there is some important information to know and look out for in 2022.

Source: forbes.com

Source: forbes.com

Parents with co-dependents under the age of 6 were eligible for 3600 or 300 monthly payments. They will receive advance payments of 550 a month a total of 3300 in 2021. WASHINGTON - Many parents across the US. The big difference in 2021 is that starting in July half of the child tax credit will be paid out via monthly payments of up to 300 per child through the end of the year. Reporting by Merdie Nzanga.

Source: taxoutreach.org

Source: taxoutreach.org

Even though child tax credit payments are scheduled to arrive on certain dates you may not have gotten the money. Advance child tax credit update september 27 2021. 823 ET Dec 28 2021. Those with co-dependents. The big difference in 2021 is that half of the child tax credit will be paid out via monthly payments of up to 300 per child through the end of the year.

Source: litrg.org.uk

Source: litrg.org.uk

For 2021 the credit increases to 3000 from 2000 per child under the age of 17 and gives an additional 600 benefit for children under the age of 6. The big difference in 2021 is that starting in July half of the child tax credit will be paid out via monthly payments of up to 300 per child through the end of the year. Child tax credit enhancement Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis which accounts for half of. The final credit was delivered in December. WASHINGTON - Many parents across the US.

Normally anyone who receives a payment this month will also receive a payment each month for the rest of 2021 unless they unenroll. The payment for children. Parents with co-dependents under the age of 6 were eligible for 3600 or 300 monthly payments. The child tax credit was provided monthly between July 15 and Dec. Those with co-dependents.

Source: cnet.com

Source: cnet.com

If their adjusted gross income is 140000 for 2021 they qualify for the full enhanced child tax credit of 6600. Those with co-dependents. The Internal Revenue Service began sending letters to recipients. One of the main adjustments included allowing families to receive part of the Child Tax Credit as monthly payments rather than waiting to get all of the money as a refund when they file their tax returns. Parents with co-dependents under the age of 6 were eligible for 3600 or 300 monthly payments.

Source: taxpayeradvocate.irs.gov

Source: taxpayeradvocate.irs.gov

Even though child tax credit payments are scheduled to arrive on certain dates you may not have gotten the money. Half the total credit amount was paid in advance monthly payments in 2021. One of the main adjustments included allowing families to receive part of the Child Tax Credit as monthly payments rather than waiting to get all of the money as a refund when they file their tax returns. With the introduction of the American Rescue Plan back in March the Child Tax Credit underwent a couple temporary changes for tax year 2021. The Internal Revenue Service began sending letters to recipients.

Source: cnbc.com

Source: cnbc.com

Advance payments were sent automatically to eligible people. In 2021 parents could receive an advance of half of their child tax credit in monthly payments. The Internal Revenue Service began sending letters to recipients. For the first time since July families are not expected to receive a 300 payment on January 15 2022. Heres a look at.

Source: hrblock.com

Source: hrblock.com

In 2021 parents could receive an advance of half of their child tax credit in monthly payments. Child tax credit enhancement Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis which accounts for half of. Editing by John Stonestreet. FAMILIES have grown used to monthly 300 payments through the expanded child tax credit but in February 2022 theres a chance the long-awaited extension could double payments. If their adjusted gross income is 140000 for 2021 they qualify for the full enhanced child tax credit of 6600.

Source: cbpp.org

Source: cbpp.org

Residents may receive half of the child tax credit for tax year 2021 for each qualifying child in equal payments from september to. Those with co-dependents. Treasury paid the last monthly child tax credit payment 16 billion in total on Wednesday. While some media outlets have taken to calling them monthly stimulus checks they are more similar though not entirely to whats known as a child allowance or family benefits in other developed countries. That can come in monthly payments 250 per.

Source: cnbc.com

Source: cnbc.com

The payment for children. The final monthly payment of 2021 went out Dec. A Blessing and a Relief. The big difference in 2021 is that half of the child tax credit will be paid out via monthly payments of up to 300 per child through the end of the year. Residents may receive half of the child tax credit for tax year 2021 for each qualifying child in equal payments from september to.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title child tax credit 2021 paid monthly by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.