Your Gift from brother in law taxable images are available. Gift from brother in law taxable are a topic that is being searched for and liked by netizens today. You can Get the Gift from brother in law taxable files here. Download all free photos.

If you’re searching for gift from brother in law taxable images information related to the gift from brother in law taxable keyword, you have visit the right blog. Our site frequently provides you with hints for downloading the highest quality video and image content, please kindly surf and find more informative video articles and graphics that fit your interests.

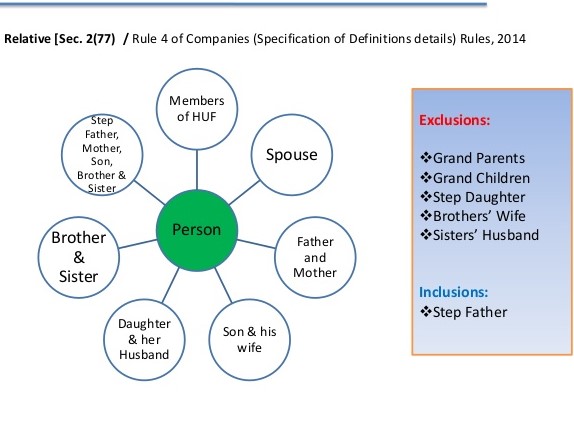

Gift From Brother In Law Taxable. If you gift money or an asset to your daughter-in-law. Avoid gifts from mothers fathermother NanaNani as these are not tax free. CA Abhishek Chordiya The law under sections 224xii rws. Gift from relatives are not taxable under the Income Tax Act.

Taxability Of Gift Received By An Individual From taxguru.in

Taxability Of Gift Received By An Individual From taxguru.in

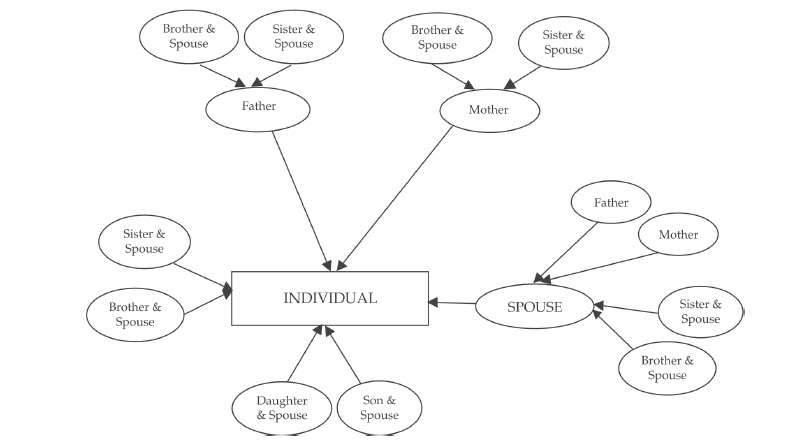

Coupon drop down remove firefox mac This happened Support Forum. Interest income earned by your wife on gift is taxable in the hand of her mother in law. Further that whether the gift so received by the assessee from his brother-in-law is exempted from tax under section 56 of the Act has been considered on a wrong notion. And for your edification Hitler Stalin and Pol Pot were all leftist politicians. Any lineal ascendant or descendant of the individual. Spouse of the person referred to in above points.

50000 to a Resident Indian who is a not a relative both giver and receiver are exempt from tax in India.

In case of Individual- Spouse of the individual Brother or sister of the individual. Grand parents can give tax free gifts. The author has conducted a detailed study of the subject and explained all the implications of the law with. Spouse of the person referred to in above points. Gifts up to Rs 50000 per annum are exempt from tax in India. Interestingly reverse is not true.

Source: carajput.com

Source: carajput.com

If the size of your estate is above your available unified credit youll owe tax on the excess amount although it would be. Any lineal ascendant or descendant of the spouse of the individual. The author has conducted a detailed study of the subject and explained all the implications of the law with. Spouse of the individual. Here the relatives term defines by the Income Tax act as follows.

Source: carajput.com

Source: carajput.com

Refer sec 56 of Income tax Act. There are debates on treating them as lineal ascendants. The term relative includes a spouse brother sister brother or sister of spouse. Any inheritance your brother receives will be completely tax-free although he may owe taxes on the future appreciation of any assets you leave him. Grand parents can give tax free gifts.

Source: makemoneygoals.com

Source: makemoneygoals.com

Gifts in the form of cash cheque items or property within Rs. Instead of relative as provided by the statute blood relative has been considered by the Learned AO and as a result whereof addition was made which is absolutely erroneous as rightly pointed out by the. Son in law is relative as per clause 5 with 7. If you gift money or an asset to your daughter-in-law. According to the IT Act following persons would be considered as relative –spouse brother or.

Tax on gifts in India falls under the purview of the Income Tax Act as there is no specific gift tax after the Gift Tax Act 1958 was repealed in 1998. Though legally no gift deed is required to be. Gift in cash or kind from Father in law or mother in law is not Taxable as received from Relatives as. Income tax on gift received from parents is tax exempt. There are debates on treating them as lineal ascendants.

Source: blog.taxbuddy.com

Source: blog.taxbuddy.com

And for your edification Hitler Stalin and Pol Pot were all leftist politicians. Gifts received from relatives are exempt from tax. Will not attract any income tax. Further that whether the gift so received by the assessee from his brotherinlaw is exempted from tax under section 56 of the Act has been considered on a wrong notion. Any lineal ascendant or descendant of the individual.

Source: bcasonline.org

Source: bcasonline.org

The author has conducted a detailed study of the subject and explained all the implications of the law with. Gift in cash or kind from Father in law or mother in law is not Taxable as received from Relatives as. Gifts received from relatives are exempt from tax. Spouse of the individual. Though legally no gift deed is required to be.

Source: thetaxtalk.com

Source: thetaxtalk.com

The following are the relatives considered for this exemption. So plz go through the defination of relative under the head of income from other sources. Uncle and aunty will be considered as gift from Relative. Further that whether the gift so received by the assessee from his brotherinlaw is exempted from tax under section 56 of the Act has been considered on a wrong notion. In addition gifts from specific relatives like parents spouse and siblings are also exempt from tax.

Source: taxguru.in

Source: taxguru.in

CA Abhishek Chordiya The law under sections 224xii rws. Gifts in the form of cash cheque items or property within Rs. Interestingly reverse is not true. Here the relatives term defines by the Income Tax act as follows. Can husband give gift to his wife.

Source: blog.taxact.com

Source: blog.taxact.com

Gifts received From Relatives As per the Income tax act the sum of money received from any of your relatives are fully exempt from tax. So the gift of 5 lakh received from your brother is not income at all and therefore you are not required to disclose it in your income tax return. If the size of your estate is above your available unified credit youll owe tax on the excess amount although it would be. Coupon drop down remove firefox mac This happened Support Forum. All gifts received from relatives irrespective of value are exempted from Gift Tax.

Source: taxguru.in

Source: taxguru.in

Son in law is relative as per clause 5 with 7. Further that whether the gift so received by the assessee from his brother-in-law is exempted from tax under section 56 of the Act has been considered on a wrong notion. Any sum of money or kind received as gift from relatives will not be taxable at all means there is no limit specified for amount gift received by relative hence any amount received by relatives is not taxable. The author has conducted a detailed study of the subject and explained all the implications of the law with. Further that whether the gift so received by the assessee from his brotherinlaw is exempted from tax under section 56 of the Act has been considered on a wrong notion.

Source: taxguru.in

Source: taxguru.in

Hence only money received from the following persons will be exempt from income tax for an individual taxpayer. R C Gupta Associate Professor 24 Points Replied. Instead of relative as provided by the statute blood relative has been considered by the Learned AO and as a result whereof addition was made which is absolutely erroneous as rightly pointed out by the. Gift from brother to brother is not taxablefurther gift transaction from B to his nephew is also tax free. Gifts up to Rs 50000 per annum are exempt from tax in India.

Source: swaritadvisors.com

Source: swaritadvisors.com

The Law on Taxability of Gifts under The Income-tax Act 1961. A Receipt of gifts from relatives is not taxable. Eg If your brother gift u Rs 50 00000 than it will not be taxable in the hand of recipient you. A Spouse of the individual b Brother or sister of the individual. In taxable brother from law gift.

Yes interest income shall be clubbed as per Section 64 1 vi CS Abhishek Goyal M Com FCS LLB M-AIMA 10339 Points Replied 08 December 2015. Brother or sister of either of the parents of the individual. Interestingly reverse is not true. The Law on Taxability of Gifts under The Income-tax Act 1961. 562vii of the Income-tax Act 1961 relating to taxation of gifts has several nuances and complications.

Source: taxguru.in

Source: taxguru.in

Uncle and aunty will be considered as gift from Relative. Can husband give gift to his wife. Grand parents can give tax free gifts. A Spouse of the individual b Brother or sister of the individual. If the size of your estate is above your available unified credit youll owe tax on the excess amount although it would be.

Source: carajput.com

Source: carajput.com

From a tax perspective giving a gift to your brother after you die is almost identical to making a gift while alive. Will not attract any income tax. Gifts in the form of cash cheque items or property within Rs. 50000 to a Resident Indian who is a not a relative both giver and receiver are exempt from tax in India. Interest income earned by your wife on gift is taxable in the hand of her mother in law.

Source: taxguru.in

Source: taxguru.in

Gifts in the form of cash cheque items or property within Rs. Coupon drop down remove firefox mac This happened Support Forum. Yes you can receive any amount as gift from your relative without any tax liability. Gifts in the form of cash cheque items or property to a Resident Indian who is a relative both giver and receiver are exempt from tax in India. Gifts received from relatives are exempt from tax.

Source: taxguru.in

Source: taxguru.in

The term relative includes a spouse brother sister brother or sister of spouse. Gifts up to Rs 50000 per annum are exempt from tax in India. Yes you can receive any amount as gift from your relative without any tax liability. Grand parents can give tax free gifts. Instead of relative as provided by the statute blood relative has been considered by the Learned AO and as a result whereof addition was made which is absolutely erroneous as rightly pointed out by the.

Source: livemint.com

Source: livemint.com

Brother or sister of either of the parents of the individual. The author has conducted a detailed study of the subject and explained all the implications of the law with. Instead of relative as provided by the statute blood relative has been considered by the Learned AO and as a result whereof addition was made which is absolutely erroneous as rightly pointed out by the. Also in the following cases gifts received are not taxable even if the value is above Rs50000. The following are the relatives considered for this exemption.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title gift from brother in law taxable by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.