Your Is gift from brother to sister taxable in india images are ready. Is gift from brother to sister taxable in india are a topic that is being searched for and liked by netizens now. You can Download the Is gift from brother to sister taxable in india files here. Get all free photos and vectors.

If you’re searching for is gift from brother to sister taxable in india images information linked to the is gift from brother to sister taxable in india keyword, you have visit the ideal site. Our website frequently provides you with hints for seeking the highest quality video and image content, please kindly search and find more enlightening video content and images that fit your interests.

Is Gift From Brother To Sister Taxable In India. 50000 in a year from anybody other than your relatives please remember there is a tax on that gift. However if the aggregate value of such gifts is less than Rs 50000 then it would be exempt from tax. The relationship of brother and sister is covered under the definition of relatives. Gift received from NRI relative to a resident Indian is exempt from tax in India for both giver and receiver Gifts to Resident Indians from NRIs non-relative within INR 50000- are exempt from tax for both giver and receiver.

Gift Tax In India Implications Exemptions Mymoneysage Blog From mymoneysage.in

Gift Tax In India Implications Exemptions Mymoneysage Blog From mymoneysage.in

However if the aggregate value of such gifts is less than Rs 50000 then it would be exempt from tax. The Indian government introduced the tax on gifts in April 1958 and the Gift Tax Act regulates it. Money sent to sister as gift in India is not taxable. The fourth restriction is an Indian resident can only give loans to a Non-resident Indian NRI relative. The said Act was introduced to impose taxation on the exchange of gifts under requisite circumstances. Gift from A bother to B brother is exempt in the hands of B by virtue of section 56 2 x of the Act.

If he is having other income then exemption would be reduced upto the amount of other income.

Gifting Stocks to other people Not a blood relative If the donee is not a blood relative of the donor as stated above then if the gift exceeds the amount of Rs50000 then it is taxable in the hands of the donee. In case of Individual- Spouse of the individual Brother or sister of the individual. The Gift Tax was introduced in India in 1958 but gift tax in India is now coming under the Income Tax Act. A brother or sister of your spouse. The Indore tax tribunal recently had the scope to analyse and interpret the law relating to gifts received from relatives in the case of Geeta Dubey vs Income-Tax Officer. Is gift in cash taxable.

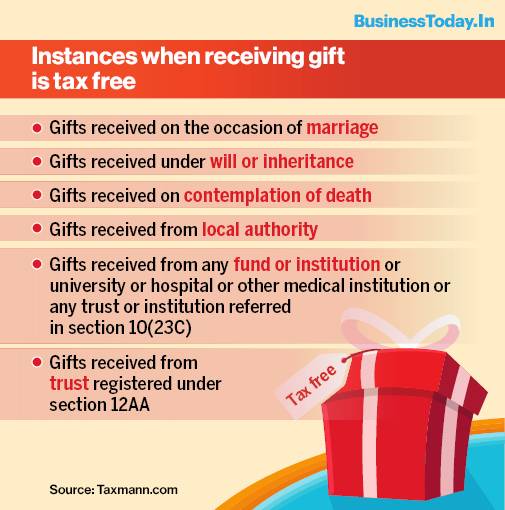

Source: businesstoday.in

Source: businesstoday.in

Your brother or sister. So just to escape gift tax in India you cant call a person your relative. General Care Because of extensive tax planning with presents contributions in India normally fall under the scrutiny of the taxation division particularly when the quantum is enormous. The amount of loan is also restricted and has some limits. Gifts in the form of cash cheque items or property within Rs.

Source: mymoneysage.in

Source: mymoneysage.in

Money sent to sister as gift in India is not taxable. A brother or sister of your father or mother. All gifts received from relatives irrespective of value are exempted from Gift Tax. What is Tax on Gifts in India. So if you are receiving more than Rs.

Source: pipanews.com

Source: pipanews.com

According to 2017s amended law any gift. STCG will be exempt for B if he does not have other income. However if the aggregate value of such gifts is less than Rs 50000 then it would be exempt from tax. For example if an individual receives gifts worth Rs 75000 in a tax year then he is required to pay tax on the full amount. All gifts received from relatives irrespective of value are exempted from Gift Tax.

Source: nriengage.com

Source: nriengage.com

According to 2017s amended law any gift. Gift received from relatives is tax free Premium Gifts received up to 50000 are completely tax free but if this amount is breached the whole amount of gifts become taxable. So the gift of 5 lakh received from your brother is not. Dubey received a gift of Rs 50000 from her father and a gift of Rs 50000 from her sister. Brothers and sisters of your parents.

Source: paisabazaar.com

Source: paisabazaar.com

There is no limit however the money should be known source of brother Ie. Investing in the name of your child parents or spouse can help in saving taxes in India. Your brother or sister. Your lineal descendants including spouses. As stated previously certainly given gifts obtained by any individual from any personpersons brings present taxation.

Source: taxguru.in

Source: taxguru.in

A brother or sister of your father or mother. Gift received from relatives is tax free Premium Gifts received up to 50000 are completely tax free but if this amount is breached the whole amount of gifts become taxable. Investing in the name of your child parents or spouse can help in saving taxes in India. The fourth restriction is an Indian resident can only give loans to a Non-resident Indian NRI relative. Money sent to sister as gift in India is not taxable.

Source: mymoneysage.in

Source: mymoneysage.in

When income tax department ask the source of fund it can be prove by evidence. When income tax department ask the source of fund it can be prove by evidence. If he is having other income then exemption would be reduced upto the amount of other income. A brother or sister of your father or mother. So just to escape gift tax in India you cant call a person your relative.

Source: taxguru.in

Source: taxguru.in

This loan can only be given for a period of one year and has to be interest free. A brother or sister of your father or mother. Gift by nephew to fathers brother is exempt but vice-versa is taxable. For example if an individual receives gifts worth Rs 75000 in a tax year then he is required to pay tax on the full amount. So just to escape gift tax in India you cant call a person your relative.

Source: taxguru.in

Source: taxguru.in

For example if an individual receives gifts worth Rs 75000 in a tax year then he is required to pay tax on the full amount. 50000 to a Resident Indian who is a not a relative both giver and receiver are exempt from tax in India. Essentially gifts here represent anything in the form of cash bank cheques demand drafts and other valuables. Gift tax in India Conclusion. If money is sent to anyone else not in.

Source: taxmantra.com

Source: taxmantra.com

The value of the gift can not be considered as deduction while calculating income tax Any income that is received from the gift in India is taxable irrespective of whether the receiver and giver are Resident Indians or NRIs Make sure to have the necessary documentation in. However if the aggregate value of such gifts is less than Rs 50000 then it would be exempt from tax. Aggregate value of cash gifts received without consideration during a financial year would be taxable as Income from Other Sources in the hands of the recipient. Your brother or sister. 50000 to a Resident Indian who is a not a relative both giver and receiver are exempt from tax in India.

Source: saraludyog.com

Source: saraludyog.com

Investing in the name of your child parents or spouse can help in saving taxes in India. Save Tax by Gifting to your Family. Your lineal descendants including spouses. STCG will be exempt for B if he does not have other income. If he is having other income then exemption would be reduced upto the amount of other income.

Source: indiafilings.com

Source: indiafilings.com

The Gift Tax was introduced in India in 1958 but gift tax in India is now coming under the Income Tax Act. Gifts up to Rs 50000 per annum are exempt from tax in India and gifts from relatives like parents spouse and siblings are also exempt from tax. So if you are receiving more than Rs. Money sent to sister as gift in India is not taxable. However if the aggregate value of such gifts is less than Rs 50000 then it would be exempt from tax.

Source: pinterest.com

Source: pinterest.com

50000 to a Resident Indian who is a not a relative both giver and receiver are exempt from tax in India. The persons who are considered as relatives. All gifts received from relatives irrespective of value are exempted from Gift Tax. So any gift amount that is sent to any of the people above is considered tax free as a gift. But below are a few exceptions for this.

Source: taxguru.in

Source: taxguru.in

The fourth restriction is an Indian resident can only give loans to a Non-resident Indian NRI relative. However if the aggregate value of such gifts is less than Rs 50000 then it would be exempt from tax. Is gift in cash taxable. For example if an individual receives gifts worth Rs 75000 in a tax year then he is required to pay tax on the full amount. So the gift of 5 lakh received from your brother is not.

Source: pipanews.com

Source: pipanews.com

Money sent to sister as gift in India is not taxable. Any spouses of the previous two. Gift by nephew to fathers brother is exempt but vice-versa is taxable. The Gift Tax was introduced in India in 1958 but gift tax in India is now coming under the Income Tax Act. Here the relatives term defines by the Income Tax act as follows.

Source: taxguru.in

Source: taxguru.in

Spouse of the individual Brother or sister of the individual Brother or sister of the spouse of the individual. Tax on Gifts in India. Here the relatives term defines by the Income Tax act as follows. Gift received from relatives is tax free Premium Gifts received up to 50000 are completely tax free but if this amount is breached the whole amount of gifts become taxable. But what about the taxability rules for gifts shared when there is no occasion.

Source: livemint.com

Source: livemint.com

Investing in the name of your child parents or spouse can help in saving taxes in India. Money sent to sister as gift in India is not taxable. What is Tax on Gifts in India. Any lineal ascendant or descendant you have. General Care Because of extensive tax planning with presents contributions in India normally fall under the scrutiny of the taxation division particularly when the quantum is enormous.

Source: cs-india.com

Source: cs-india.com

50000 to a Resident Indian who is a not a relative both giver and receiver are exempt from tax in India. The Indian government introduced the tax on gifts in April 1958 and the Gift Tax Act regulates it. This loan can only be given for a period of one year and has to be interest free. The Indore tax tribunal recently had the scope to analyse and interpret the law relating to gifts received from relatives in the case of Geeta Dubey vs Income-Tax Officer. Spouse of the individual Brother or sister of the individual Brother or sister of the spouse of the individual.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title is gift from brother to sister taxable in india by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.