Your Tax filing deadline 2021 canada extension images are available in this site. Tax filing deadline 2021 canada extension are a topic that is being searched for and liked by netizens today. You can Download the Tax filing deadline 2021 canada extension files here. Get all royalty-free photos.

If you’re searching for tax filing deadline 2021 canada extension pictures information linked to the tax filing deadline 2021 canada extension topic, you have visit the right blog. Our site always gives you suggestions for viewing the highest quality video and picture content, please kindly search and find more informative video articles and images that match your interests.

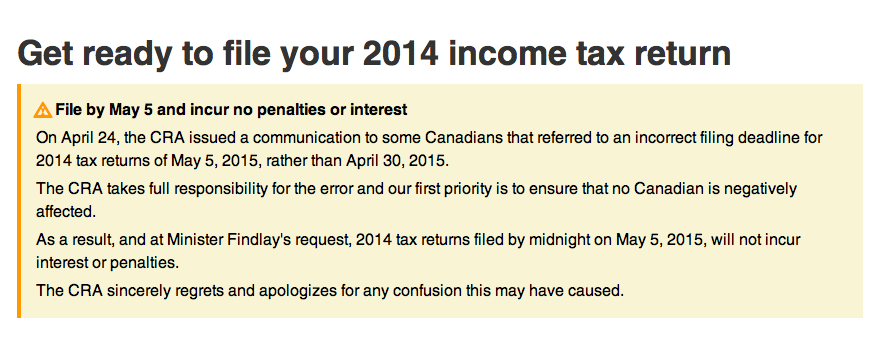

Tax Filing Deadline 2021 Canada Extension. Last year the federal government extended the tax filing deadline to May 31 and subsequently suspended late payment penalties until September. The CRA has reconfirmed that these due dates still apply. Individual tax filers regardless of income can use Free File to electronically request an automatic tax-filing extension. The CRAs tax-filing deadline is April 30 2021 In March the CRA announced one-year relief on the interest charged on income tax dues.

Upon filing an extension you will have until October 15 to file a tax return but the unpaid taxes. E-file Your Extension Form for Free. However the CRA hasnt announced an extension in 2021 similar to last year. But youll still need to pay any taxes you owe by May 17. If you file for an extension youll have until October 15 2021 to file your taxes. The current worsening situation with the pandemic across our country is creating an unprecedented strain on the resources of tax preparers and many believe that they.

The tax-filing deadline for most Canadians for the 2021 tax year is on May 2 2022.

The CRAs tax-filing deadline is April 30 2021 In March the CRA announced one-year relief on the interest charged on income tax dues. Normally the general tax filing deadline date is on April 30th each year but in 2022 this date falls on a Saturday so theres an extension until the next business day. We the undersigned are preparers of individual income tax returns for Canadian taxpayers and we are concerned about being able to complete this work with appropriate due care by the upcoming deadline of April 30. But youll still need to pay any taxes you owe by May 17. 22 2021 with April 30 set as the deadline for individual taxpayers Getty Imagesizusek Its tax season again. This extension also applies to 2020 tax payments.

This extension also applies to 2020 tax payments. This extraordinary step was taken in response to the sudden economic crisis caused by the COVID-19 pandemic as a way of providing immediate financial relief for individuals and small businesses. No extension of ITR filing deadline confirms government. Section 2164 and Section 2165 - Non-residents with Canadian rental income Deadlines. COVID-19 tax filing deadline extension On March 18 2020 the Canadian government announced changes to a number of key CRA tax deadlines in 2020.

Source: myexpattaxes.com

Source: myexpattaxes.com

Its also important to note that the income tax refund schedule remains unchanged. The new federal tax filing deadline is automatic so you dont need to file for an extension unless you need more time to file after May 17 2021. Barring a government announcement the majority of Canadians will have to meet their tax-filing obligations by April 30. Investing in telecom giant bce tsxbcenyse. E-file Your Extension Form for Free.

Source: myexpattaxes.com

Source: myexpattaxes.com

Taxpayers have until the regular yearly deadline or April 30. This extraordinary step was taken in response to the sudden economic crisis caused by the COVID-19 pandemic as a way of providing immediate financial relief for individuals and small businesses. The tax filing deadline for 2020 is April 30. The current worsening situation with the pandemic across our country is creating an unprecedented strain on the resources of tax preparers and many believe that they. If you file for an extension youll have until October 15 2021 to file your taxes.

Source: christiansoncpa.com

Source: christiansoncpa.com

Last year the federal government extended the tax filing deadline to May 31 and subsequently suspended late payment penalties until September. If you cannot file your tax return by the deadline you need to file for a tax extension by May 17 2021. Even though the ITR filing deadline was extended twice for the financial year many were not able to complete the exercise on time due to many glitches on the newly launched e-filing portal. The CRA has reconfirmed that these due dates still apply. Tax Filing Deadline 2021 is the same as any other year and if you need additional time you can file a tax extension to request more time from the IRS to file a tax return.

Source: sterncohen.com

Source: sterncohen.com

Of note the table in section A1 indicates that because the T2 filing due date for corporations with taxation year-ends from November 30 2019 to February 29 2020 were extended to September 1 2020 the federal SRED reporting deadlines for these tax years have been extended to September 1 2021. Income Tax Return Filing Due Date. The current worsening situation with the pandemic across our country is creating an unprecedented strain on the resources of tax preparers and many believe that they. COVID-19 tax filing deadline extension On March 18 2020 the Canadian government announced changes to a number of key CRA tax deadlines in 2020. But this year the government is.

Source: rsm.global

Source: rsm.global

Even though the ITR filing deadline was extended twice for the financial year many were not able to complete the exercise on time due to many glitches on the newly launched e-filing portal. The CRAs tax-filing deadline is April 30 2021 In March the CRA announced one-year relief on the interest charged on income tax dues. Tax-filing season started on Feb. The current worsening situation with the pandemic across our country is creating an unprecedented strain on the resources of tax preparers and many believe that they. This extraordinary step was taken in response to the sudden economic crisis caused by the COVID-19 pandemic as a way of providing immediate financial relief for individuals and small businesses.

Source: brighttax.com

Source: brighttax.com

Canadian Tax Deadline 2021 Extension. However the CRA hasnt announced an extension in 2021 similar to last year. This year many Canadians will probably have a more complicated return especially those who collected CERB or have worked from home. The current worsening situation with the pandemic across our country is creating an unprecedented strain on the resources of tax preparers and many believe that they. This serves as an incentive for people to still file sooner rather than later.

Source: timescolonist.com

Source: timescolonist.com

Individual tax filers regardless of income can use Free File to electronically request an automatic tax-filing extension. The current worsening situation with the pandemic across our country is creating an unprecedented strain on the resources of tax preparers and many believe that they. Revenue Secretary Tarun Bajaj said December 31 2021 remains the official deadline for filing of income tax returns. The tax-filing deadline for most Canadians for the 2021 tax year is on May 2 2022. Income Tax Return Filing Due Date.

Source: politico.com

Source: politico.com

Revenue Secretary Tarun Bajaj said December 31 2021 remains the official deadline for filing of income tax returns. Of note the table in section A1 indicates that because the T2 filing due date for corporations with taxation year-ends from November 30 2019 to February 29 2020 were extended to September 1 2020 the federal SRED reporting deadlines for these tax years have been extended to September 1 2021. This year many Canadians will probably have a more complicated return especially those who collected CERB or have worked from home. E-file Your Extension Form for Free. This extension also applies to 2020 tax payments.

Source: brighttax.com

Source: brighttax.com

Canadas 2021 tax deadline is still April 30. The CRAs tax-filing deadline is April 30 2021 In March the CRA announced one-year relief on the interest charged on income tax dues. The income tax return ITR filing deadline for FY 2020-21 December 31 2021 was not extended any further by the government. Canadas 2021 tax deadline is still April 30. Section 2164 and Section 2165 - Non-residents with Canadian rental income Deadlines.

Source: shutterstock.com

Source: shutterstock.com

But this year the government is. We the undersigned are preparers of individual income tax returns for Canadian taxpayers and we are concerned about being able to complete this work with appropriate due care by the upcoming deadline of April 30. The current worsening situation with the pandemic across our country is creating an unprecedented strain on the resources of tax preparers and many believe that they. This year many Canadians will probably have a more complicated return especially those who collected CERB or have worked from home. The new federal tax filing deadline.

Source: fool.ca

Source: fool.ca

Individual tax filers regardless of income can use Free File to electronically request an automatic tax-filing extension. If you file for an extension youll have until October 15 2021 to file your taxes. Barring a government announcement the majority of Canadians will have to meet their tax-filing obligations by April 30. Individual tax filers regardless of income can use Free File to electronically request an automatic tax-filing extension. Revenue Secretary Tarun Bajaj said December 31 2021 remains the official deadline for filing of income tax returns.

This year many Canadians will probably have a more complicated return especially those who collected CERB or have worked from home. Tax Filing Deadline 2021 is the same as any other year and if you need additional time you can file a tax extension to request more time from the IRS to file a tax return. Section 2164 and Section 2165 - Non-residents with Canadian rental income Deadlines. Investing in telecom giant bce tsxbcenyse. If your tax year ends September 23 your filing due date is March 23.

Source: cpapracticeadvisor.com

Source: cpapracticeadvisor.com

Canadas 2021 tax deadline is still April 30. Revenue Secretary Tarun Bajaj said December 31 2021 remains the official deadline for filing of income tax returns. Despite renewed school and business shut-downs in parts of the country due to the third wave of the COVID-19 pandemic Ottawa did not prolong the tax. Without a tax extension the tax filing and payment deadline is April 15. Income Tax Return Filing Due Date.

Source:

Source:

Tax Filing Deadline 2021 is the same as any other year and if you need additional time you can file a tax extension to request more time from the IRS to file a tax return. Tax Filing Deadline 2021 is the same as any other year and if you need additional time you can file a tax extension to request more time from the IRS to file a tax return. But this year the government is. Individual tax filers regardless of income can use Free File to electronically request an automatic tax-filing extension. Of note the table in section A1 indicates that because the T2 filing due date for corporations with taxation year-ends from November 30 2019 to February 29 2020 were extended to September 1 2020 the federal SRED reporting deadlines for these tax years have been extended to September 1 2021.

Source: bdo.ca

Source: bdo.ca

Tax Filing Deadline 2021 is the same as any other year and if you need additional time you can file a tax extension to request more time from the IRS to file a tax return. You must file your extension request no later than the regular due date of your return. The tax filing deadline for 2020 is April 30. Investing in telecom giant bce tsxbcenyse. Taxpayers have until the regular yearly deadline or April 30.

Source: hlbthai.com

Source: hlbthai.com

If you sent the CRA Form NR6 and the CRA approved it for 2020 you have to file your section 216 return for 2020 by June 30 2021. The tax filing deadline for 2020 is April 30. The CRAs tax-filing deadline is April 30 2021 In March the CRA announced one-year relief on the interest charged on income tax dues. You must file your extension request no later than the regular due date of your return. Upon filing an extension you will have until October 15 to file a tax return but the unpaid taxes.

Source: myexpattaxes.com

Source: myexpattaxes.com

This year many Canadians will probably have a more complicated return especially those who collected CERB or have worked from home. Upon filing an extension you will have until October 15 to file a tax return but the unpaid taxes. E-file Your Extension Form for Free. The tax filing deadline for 2020 is April 30. The tax-filing deadline for most Canadians for the 2021 tax year is on May 2 2022.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tax filing deadline 2021 canada extension by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.