Your What age are child tax credits paid to images are available in this site. What age are child tax credits paid to are a topic that is being searched for and liked by netizens today. You can Download the What age are child tax credits paid to files here. Find and Download all free images.

If you’re searching for what age are child tax credits paid to pictures information linked to the what age are child tax credits paid to topic, you have visit the right site. Our site always gives you suggestions for seeing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and images that fit your interests.

What Age Are Child Tax Credits Paid To. For tax year 2021 the Child Tax Credit is increased from 2000 per qualifying child to. According to the IRS those eligible for payments include an individual who does not turn 18 before January 1 2022. Couples earning as much as 150000 a. Child Tax Credit and Working Tax Credit do not affect Child Benefit payments which we pay separately.

What To Know About The First Advance Child Tax Credit Payment From cnbc.com

What To Know About The First Advance Child Tax Credit Payment From cnbc.com

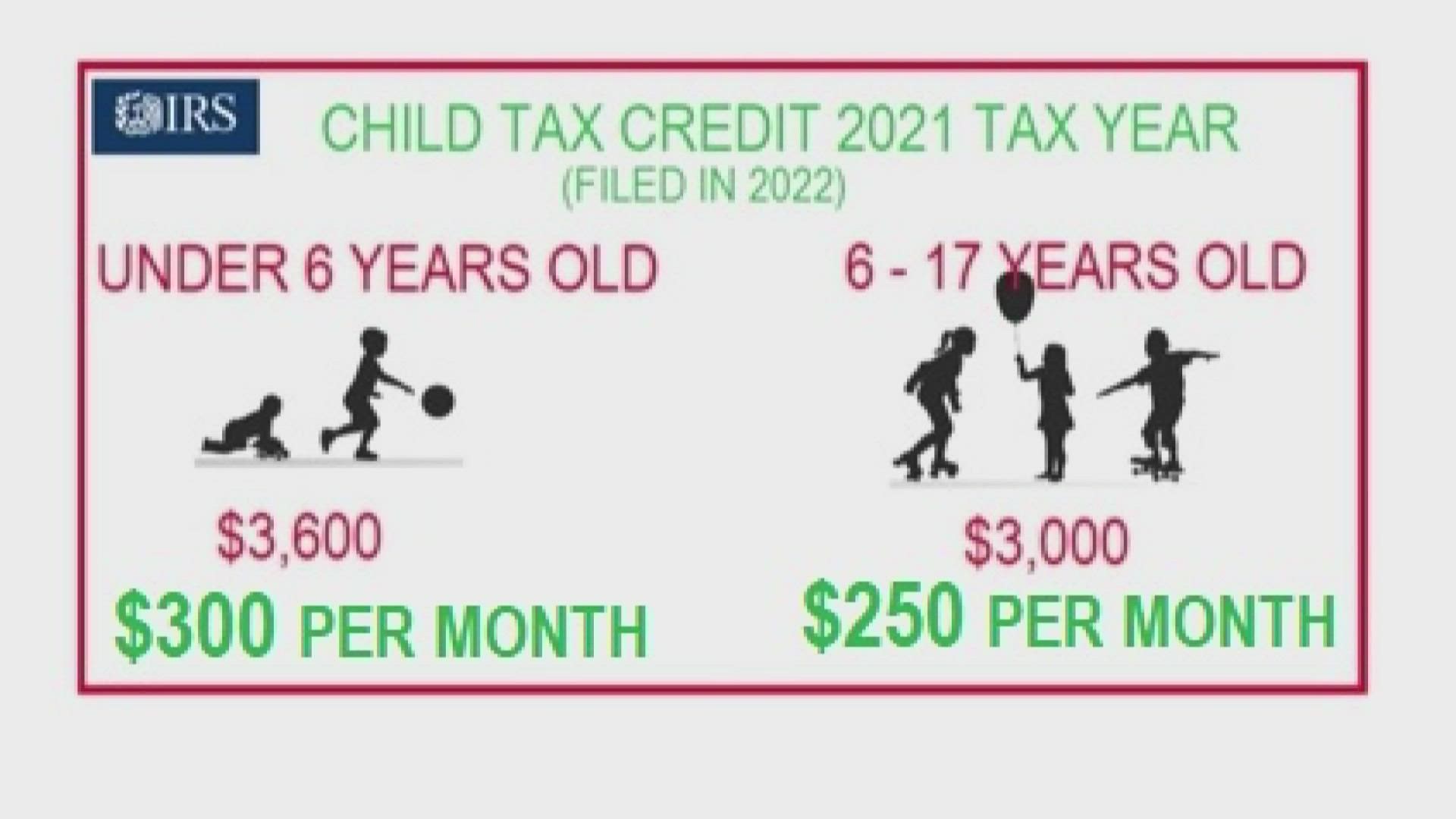

You may be able to get a Child Tax Credit for each of your qualifying children under age 18. You do not need to take any additional action to get advance payments. So for example if your childs 16th birthday was 1 June 2021 your child tax credit would stop on 1 September 2021. According to the IRS those eligible for payments include an individual who does not turn 18 before January 1 2022. For example if your 5-year-old turns 6 in 2021 that would qualify you for a smaller payment. The reformed tax credit will pay up to 3600 for children five and under and up to 3000 for children six to 17 in 2021.

You do not need to take any additional action to get advance payments.

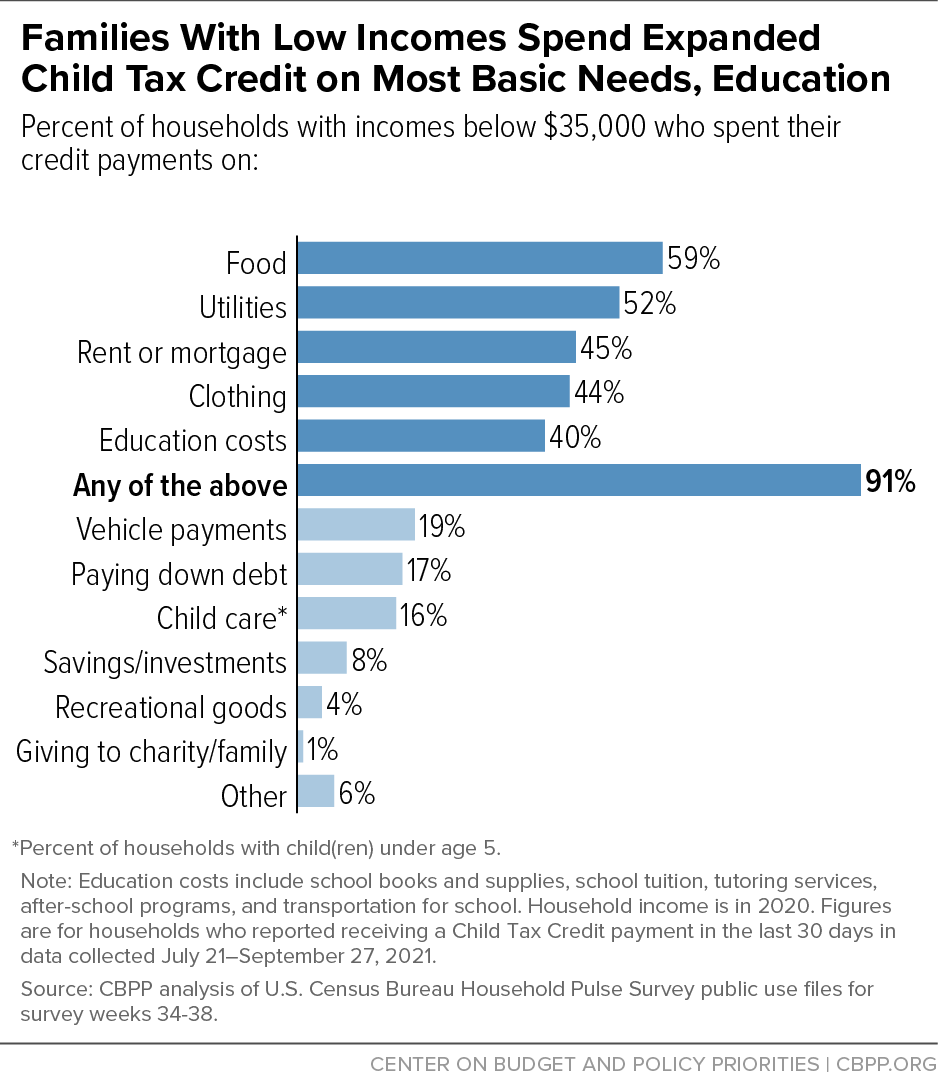

Its reducing child poverty and food insufficiency. A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number. Kids between the ages. In most cases Child Tax Credit stops once your child reaches 16 years old. The 500 nonrefundable Credit for Other Dependents amount has not changed. To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of.

Source: en.wikipedia.org

Source: en.wikipedia.org

Child Tax Credit and Working Tax Credit do not affect Child Benefit payments which we pay separately. The 500 nonrefundable Credit for Other Dependents amount has not changed. But they would need to be in approved education or certain approved training schemes. Child tax credit payments apply to families with children 17 and younger. Youre paid every week or every 4 weeks from the date of your claim up to the end of the tax year 5 April unless your circumstances change.

Source: 13newsnow.com

Source: 13newsnow.com

You and your spouse or common-law partner must file your 2019 and 2020 tax returns to get all four payments. The reformed tax credit will pay up to 3600 for children five and under and up to 3000 for children six to 17 in 2021. Youre already claiming Child Tax Credit. If your child is 18 or will turn 18 before the end of the year you will not receive a child tax credit payment. If theyre an adopted child they must have lived with you for the entire tax year.

Source: cbpp.org

Source: cbpp.org

A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number. Its reducing child poverty and food insufficiency. Couples earning as much as 150000 a. But they would need to be in approved education or certain approved training schemes. Child Tax Credit supports families with children.

Source: cnbc.com

Source: cnbc.com

A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number. The amount you get is based on your income. Exceptions exist for some teenagers until they reach 20 years old. Of that 1500 was sent via the monthly checks or 250 per month. Child tax credit enhancement Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis which accounts for half of.

Source: cbsnews.com

Source: cbsnews.com

The 500 nonrefundable Credit for Other Dependents amount has not changed. For tax year 2021 the Child Tax Credit is increased from 2000 per qualifying child to. Youre paid every week or every 4 weeks from the date of your claim up to the end of the tax year 5 April unless your circumstances change. Or if your 17-year-old turns. If you have dependents who are 17 years of age or younger they can each count toward the new child tax credit.

Source: en.wikipedia.org

Source: en.wikipedia.org

Child Tax Credit Rates 202122 Tax Year. But they would need to be in approved education or certain approved training schemes. The credit will allow 17 year-old dependents to qualify and provide up to 3000 per qualifying child or 3600 per qualifying child under age 6. If you have dependents who are 17 years of age or younger they can each count toward the new child tax credit. It gets paid out each year for the family element but you may get extra elements on top.

Source: cbpp.org

Source: cbpp.org

The CCB young child supplement is paid to families who are entitled to receive a Canada child benefit CCB payment in January April July or October 2021 for each child under the age of six. Of that 1500 was sent via the monthly checks or 250 per month. The reformed tax credit will pay up to 3600 for children five and under and up to 3000 for children six to 17 in 2021. This can include children until their 16th birthday and young persons aged from 16 but under 20 years old. Age By the end of the tax year the qualifying children must be under the age of 17.

Source: cbpp.org

Source: cbpp.org

But the expanded tax credit doesnt just go to the poor. So for example if your childs 16th birthday was 1 June 2021 your child tax credit would stop on 1 September 2021. The maximum amount you can get for each child is 3000 per child for children over the age of six and 3600 for children under the age of six for Tax Year 2021. Child Tax Credit Rates 202122 Tax Year. Child Tax Credit and Working Tax Credit do not affect Child Benefit payments which we pay separately.

Relationship The child must be related by blood a grandchild stepchild or an adopted child. Families with children between 6 to 17 receive a 3000 tax credit. Of that 1500 was sent via the monthly checks or 250 per month. Child tax credit payments apply to families with children 17 and younger. Child tax credit enhancement Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis which accounts for half of.

Source: fox4kc.com

Source: fox4kc.com

But they would need to be in approved education or certain approved training schemes. You can claim whether or not you are in work. How does child tax credit work. Dependency A child can only be claimed as a dependent on a single tax return. Child tax credit payments apply to families with children 17 and younger.

Source: ally.com

Source: ally.com

Dependency A child can only be claimed as a dependent on a single tax return. It gets paid out each year for the family element but you may get extra elements on top. Youre already claiming Child Tax Credit. The amount you get is based on your income. The reformed tax credit will pay up to 3600 for children five and under and up to 3000 for children six to 17 in 2021.

Source: thetaxadviser.com

Source: thetaxadviser.com

The Child Tax Credit works differently in 2021 and has received an increased amount. This partially-refundable credit is intended to offset the cost of raising children. Child Tax Credit and Working Tax Credit do not affect Child Benefit payments which we pay separately. A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Additionally a portion of your amount is reduced by 50 for every 1000 over certain income limits see the FAQs below.

Source: 9news.com

Source: 9news.com

According to the IRS those eligible for payments include an individual who does not turn 18 before January 1 2022. How does child tax credit work. But the expanded tax credit doesnt just go to the poor. Youre already claiming Child Tax Credit. Child Tax Credit for children over the age of sixteen 16 can continue in some cases.

Source: 10tv.com

Source: 10tv.com

In most cases Child Tax Credit stops once your child reaches 16 years old. Relationship The child must be related by blood a grandchild stepchild or an adopted child. The basic amount has an upper threshold of 545. But they would need to be in approved education or certain approved training schemes. The amount you get is based on your income.

Source: researchgate.net

Source: researchgate.net

You may be able to get a Child Tax Credit for each of your qualifying children under age 18. And Made less than certain income limits. This can include children until their 16th birthday and young persons aged from 16 but under 20 years old. A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number. In most cases Child Tax Credit stops once your child reaches 16 years old.

Source:

Source:

Yearly amount up to 545. It gets paid out each year for the family element but you may get extra elements on top. Of that 1500 was sent via the monthly checks or 250 per month. Child Tax Credit supports families with children. Child Tax Credit and Working Tax Credit do not affect Child Benefit payments which we pay separately.

Source: districtcapitalmanagement.com

Source: districtcapitalmanagement.com

If your child is 18 or will turn 18 before the end of the year you will not receive a child tax credit payment. The 500 nonrefundable Credit for Other Dependents amount has not changed. It will depend on your circumstances income and whether your child has a disability. Relationship The child must be related by blood a grandchild stepchild or an adopted child. Child tax credit will be paid until the September following your childs 16th birthday.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

You may be able to get a Child Tax Credit for each of your qualifying children under age 18. Youre already claiming Child Tax Credit. Child tax credit enhancement Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis which accounts for half of. Most read in Money. Child Tax Credit and Working Tax Credit do not affect Child Benefit payments which we pay separately.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what age are child tax credits paid to by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.