Your What day is child tax credits paid images are available in this site. What day is child tax credits paid are a topic that is being searched for and liked by netizens now. You can Find and Download the What day is child tax credits paid files here. Download all royalty-free photos.

If you’re looking for what day is child tax credits paid images information connected with to the what day is child tax credits paid keyword, you have pay a visit to the right blog. Our website always gives you suggestions for refferencing the highest quality video and image content, please kindly search and find more informative video articles and images that match your interests.

What Day Is Child Tax Credits Paid. Who gets up to 1800 per child. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. Your payment dates Tax credit payments are made every week or every 4 weeks. The next and last payment goes out on Dec.

Child Tax Credit Payments Will You Get 1 800 More Per Kid This Year Cnet From cnet.com

Child Tax Credit Payments Will You Get 1 800 More Per Kid This Year Cnet From cnet.com

You do not have to be working to claim Child Tax Credit. Who gets up to 1800 per child. The final payment for the year will arrive Dec. The number of children you have can determine your eligibility for the Earned Income Tax Credit which can be a huge savings. Under the American Rescue Plan each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. But the expanded tax credit doesnt just go to the poor.

Besides the July 15 payment payment dates are.

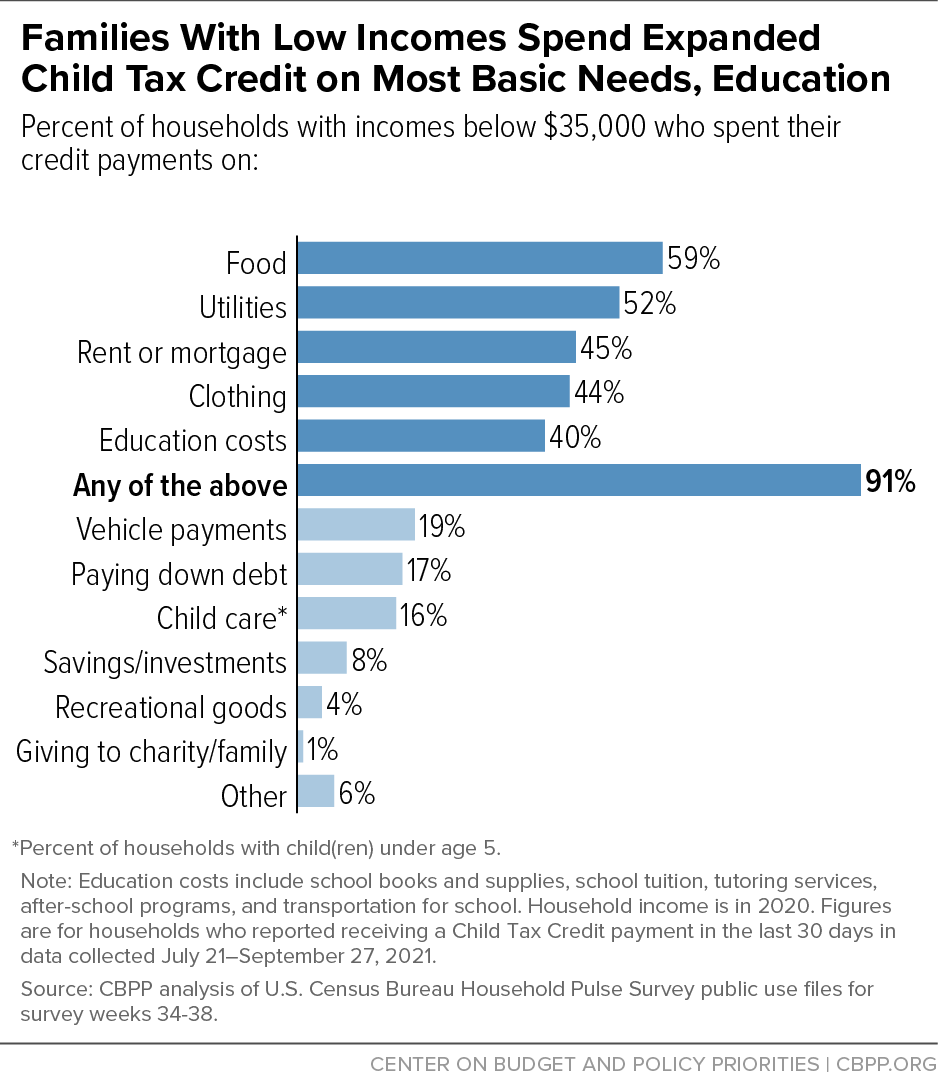

Benefit payment dates vary between individuals but if your payment date falls on the substitute bank holiday dates of Monday 27 December or Tuesday 28 December you will receive your payment on. For example in 2021 if you have three or more children and earn less than 51464 as a single. How to Avoid Paying Back the Child Tax Credit The letters went out to families who may have been eligible based on information included in either their 2019 or 2020 federal income tax return. You will claim the other half when you file your 2021 income tax return. Since payments have been going out since July that would mean they would be getting in a total of up 1800 per child once the next installment is sent out on December 15. Its reducing child poverty and food insufficiency.

Source: cnbc.com

Source: cnbc.com

The final payment for the year will arrive Dec. However the deadline to apply for the child. Besides the July 15 payment payment dates are. You do not have to be working to claim Child Tax Credit. How to Avoid Paying Back the Child Tax Credit The letters went out to families who may have been eligible based on information included in either their 2019 or 2020 federal income tax return.

Source: cbsnews.com

Source: cbsnews.com

You choose if you want to get paid weekly or every 4 weeks on your claim form. Some families should expect a. For example in 2021 if you have three or more children and earn less than 51464 as a single. THE final child tax credit payment of 2021 will be sent on December 15. When does the Child Tax Credit arrive in December.

Source: forbes.com

Source: forbes.com

Since payments have been going out since July that would mean they would be getting in a total of up 1800 per child once the next installment is sent out on December 15. How to Avoid Paying Back the Child Tax Credit The letters went out to families who may have been eligible based on information included in either their 2019 or 2020 federal income tax return. Its reducing child poverty and food insufficiency. For example in 2021 if you have three or more children and earn less than 51464 as a single. You choose if you want to get paid weekly or every 4 weeks on your claim form.

Since payments have been going out since July that would mean they would be getting in a total of up 1800 per child once the next installment is sent out on December 15. Half the total credit amount will be paid in advance monthly payments and eligible taxpayers may claim the other half when they file their 2021 income tax return. The payments go out on the 15th of each month except on weekends so the November payment will come Monday. Some families should expect a. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

Source: cbpp.org

Source: cbpp.org

When does the Child Tax Credit arrive in December. This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. Youre paid every week or every 4 weeks from the date of your claim up to the end of the tax year 5 April unless your circumstances change. Since payments have been going out since July that would mean they would be getting in a total of up 1800 per child once the next installment is sent out on December 15. Who gets up to 1800 per child.

Source: cnet.com

Source: cnet.com

For those that prefer to receive their Child Tax Credit in full with their 2021 income tax return they may. Since payments have been going out since July that would mean they would be getting in a total of up 1800 per child once the next installment is sent out on December 15. Normally anyone who receives a payment this month will also receive a payment each month for the rest of 2021 unless they unenroll. But the expanded tax credit doesnt just go to the poor. The final payment for the year will arrive Dec.

Source: cbpp.org

Source: cbpp.org

Besides the July 15 payment payment dates are. Businesses and Self Employed Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. Normally anyone who receives a payment this month will also receive a payment each month for the rest of 2021 unless they unenroll. Couples earning as much as 150000 a. The fifth payment date is Wednesday December 15 with the IRS sending most of the checks via direct deposit.

Source: cnet.com

Source: cnet.com

15 by direct deposit and through the mail. Youre paid every week or every 4 weeks from the date of your claim up to the end of the tax year 5 April unless your circumstances change. When and how will I receive it. Who gets up to 1800 per child. THE final child tax credit payment of 2021 will be sent on December 15.

Source: forbes.com

Source: forbes.com

Unless the Senate passes the Build Back Better Act that passed the House last month December 15th will be the final CTC. This is providing they. How to Avoid Paying Back the Child Tax Credit The letters went out to families who may have been eligible based on information included in either their 2019 or 2020 federal income tax return. But the expanded tax credit doesnt just go to the poor. However the deadline to apply for the child.

Source: cnbc.com

Source: cnbc.com

When does the Child Tax Credit arrive in December. The Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever and as of July 15 th most families are. You can claim the remainder when you file your 2021 tax return. How to Avoid Paying Back the Child Tax Credit The letters went out to families who may have been eligible based on information included in either their 2019 or 2020 federal income tax return. After this you can still claim for a qualifying young person as long as they are under 20.

Source: taxpayeradvocate.irs.gov

Source: taxpayeradvocate.irs.gov

Benefit payment dates vary between individuals but if your payment date falls on the substitute bank holiday dates of Monday 27 December or Tuesday 28 December you will receive your payment on. Businesses and Self Employed Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. When and how will I receive it. Under the American Rescue Plan each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17.

Source: cnet.com

Source: cnet.com

Your payment dates Tax credit payments are made every week or every 4 weeks. You can claim the remainder when you file your 2021 tax return. The next and last payment goes out on Dec. This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. After this you can still claim for a qualifying young person as long as they are under 20.

Source: cnet.com

Source: cnet.com

The federal Child Tax Credit is kicking off its first monthly cash payments on July 15 when the IRS will begin disbursing checks to eligible families with children ages 17. You can usually get Child Tax Credit for a child who lives with you until 31 August after their 16th birthday. The number of children you have can determine your eligibility for the Earned Income Tax Credit which can be a huge savings. The IRS will deposit the sixth payment of up to 300 directly into the accounts of millions of Americans on Wednesday. Normally anyone who receives a payment this month will also receive a payment each month for the rest of 2021 unless they unenroll.

Source: make-it-in-germany.com

Source: make-it-in-germany.com

This is providing they. Advance payments of the Child Tax Credit will begin in the summer of 2021. This is providing they. The same rule applies for all other benefits including state pension PIP child benefit and income support. Normally anyone who receives a payment this month will also receive a payment each month for the rest of 2021 unless they unenroll.

Source: litrg.org.uk

Source: litrg.org.uk

Couples earning as much as 150000 a. The federal Child Tax Credit is kicking off its first monthly cash payments on July 15 when the IRS will begin disbursing checks to eligible families with children ages 17. Businesses and Self Employed Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. You can usually get Child Tax Credit for a child who lives with you until 31 August after their 16th birthday. Under the American Rescue Plan each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17.

Source: cnbc.com

Source: cnbc.com

Normally anyone who receives a payment this month will also receive a payment each month for the rest of 2021 unless they unenroll. When does the Child Tax Credit arrive in December. Youre paid every week or every 4 weeks from the date of your claim up to the end of the tax year 5 April unless your circumstances change. Normally anyone who receives a payment this month will also receive a payment each month for the rest of 2021 unless they unenroll. Advance payments of the Child Tax Credit will begin in the summer of 2021.

Source: cnet.com

Source: cnet.com

The final payment for the year will arrive Dec. For example in 2021 if you have three or more children and earn less than 51464 as a single. You can usually get Child Tax Credit for a child who lives with you until 31 August after their 16th birthday. You can claim the remainder when you file your 2021 tax return. Businesses and Self Employed Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer.

Source: whitehouse.gov

Source: whitehouse.gov

The number of children you have can determine your eligibility for the Earned Income Tax Credit which can be a huge savings. You can usually get Child Tax Credit for a child who lives with you until 31 August after their 16th birthday. Unless the Senate passes the Build Back Better Act that passed the House last month December 15th will be the final CTC. The Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever and as of July 15 th most families are. The next and last payment goes out on Dec.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what day is child tax credits paid by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.