Your What is the tax deadline for 2021 in indiana images are ready. What is the tax deadline for 2021 in indiana are a topic that is being searched for and liked by netizens now. You can Download the What is the tax deadline for 2021 in indiana files here. Find and Download all royalty-free vectors.

If you’re looking for what is the tax deadline for 2021 in indiana pictures information linked to the what is the tax deadline for 2021 in indiana keyword, you have pay a visit to the right site. Our site always gives you suggestions for seeing the maximum quality video and image content, please kindly hunt and find more enlightening video content and images that match your interests.

What Is The Tax Deadline For 2021 In Indiana. The extension only shifts the filing deadline and not the payment deadline. 1019 ET Jan 6 2022. A timely filed extension moves the federal tax filing deadline to October 15 2021 and the Indiana filing deadline to November 15 2021. Any other person who is obliged to furnish the tax audit report.

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset From smartasset.com

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset From smartasset.com

Even though the ITR filing deadline was extended twice for the financial year many were not able to complete the exercise on time due to many glitches on the newly launched e-filing portal. Automatic 125 tax refunds to be sent out how to ensure youre registered before the deadline. The extension only shifts the filing deadline and not the payment deadline. The due date of furnishing of Return of Income for the Assessment Year 2021-22 which is 30th November 2021 under sub-section 1 of section 139 of the Act as extended to 31st December 2021 vide Circular No92021 dated 20052021 is hereby further extended to 28th February 2022. Due date for furnishing of challan-cum-statement in respect of tax deducted under. Check the new Income Tax filing deadlines for FY 2020-21 AY 2021-22.

For retirement plans filing Federal form 990T the return must be filed by the 15 th day of the 5 th.

Income Tax Return Latest Update. DOR Provides Additional Important Information on Unemployment Income. 1019 ET Jan 6 2022. It is important to note that the extension only shifts the filing deadline and not the payment deadline. A timely filed extension moves the federal tax filing deadline to October 15 2021 and the Indiana filing deadline to November 15 2021 Indiana DOR explained in announcing the extension. 1 For regular taxpayers the due date of of furnishing return of income for the Assessment Year 2021-22 has been extended to.

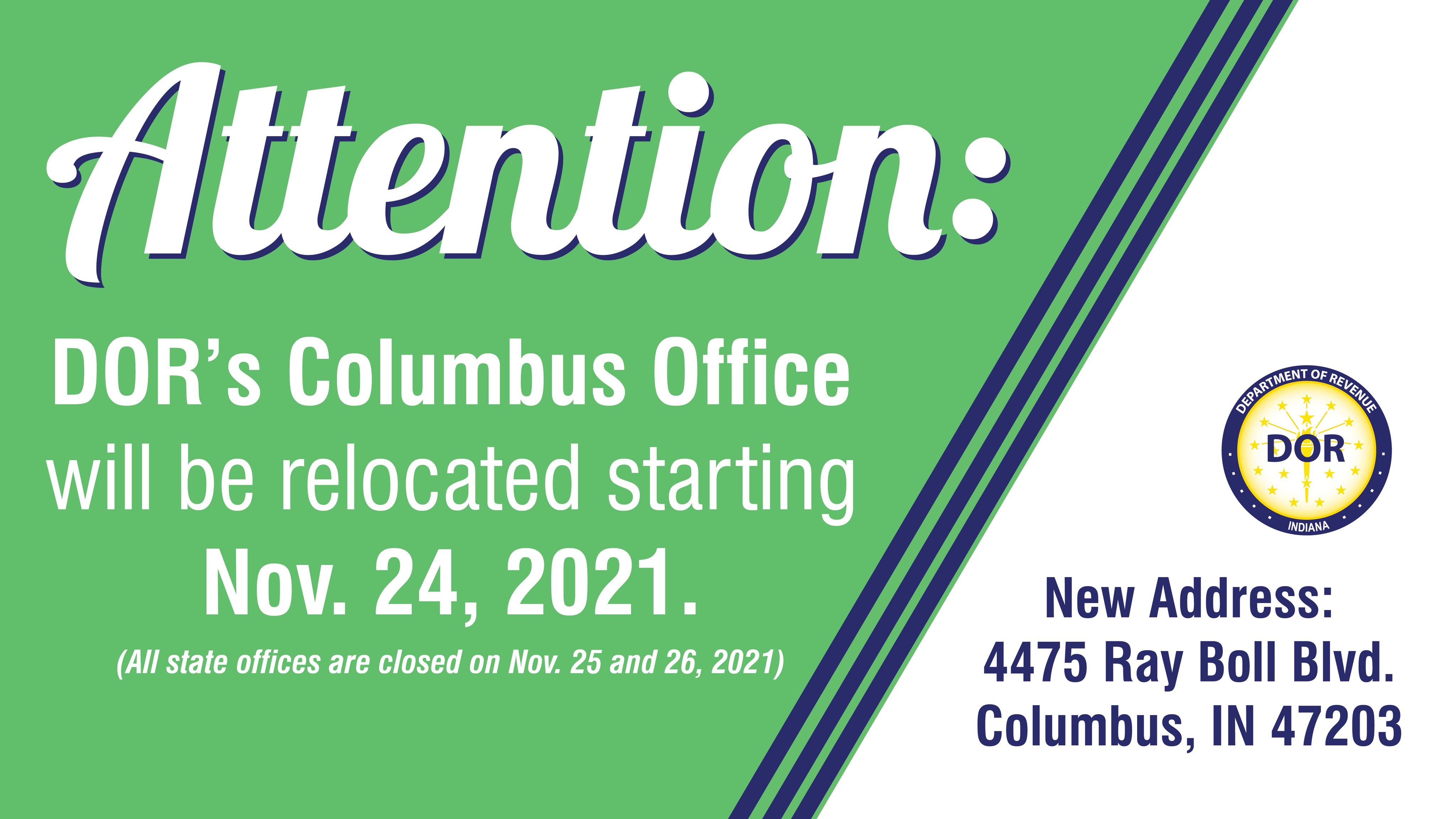

Source: events.in.gov

Source: events.in.gov

A timely filed extension moves the federal tax filing deadline to October 15 2021 and the Indiana filing deadline to November 15 2021. MILLIONS of Americans in one state will be getting an automatic refund after they file their taxes for 2021. Due date for furnishing of challan-cum-statement in respect of tax deducted under. Indiana taxpayers can claim a 20 tax credit for contributions to an Indiana CollegeChoice 529 plan maximum 1000 per year against state income tax. 1 For regular taxpayers the due date of of furnishing return of income for the Assessment Year 2021-22 has been extended to.

Source: forbes.com

Source: forbes.com

It is important to note that the extension only shifts the filing deadline and not the payment deadline. For retirement plans filing Federal form 990T the return must be filed by the 15 th day of the 5 th. Click here to get more information. HM Revenue and Customs HMRC must receive your tax return and any money you owe by the deadline. IRS and Indiana DOR Extend Tax Filing Deadline to May 17 2021 March 26 2021.

Source:

Source:

Tax returns for assessment year 2021-22 is. The deadline change applies to the 2020 individual income tax returns previously due on April 15 2021 and any payments due on those returns. Automatic 125 tax refunds to be sent out how to ensure youre registered before the deadline. The Treasury Department and Internal Revenue Service announced on March 17 that the federal income tax filing and payment due date for individuals for the 2020 tax year will be automatically extended from April 15 2021 to May 17 2021. The last tax year started on 6 April 2020 and ended on 5.

Source: cnet.com

Source: cnet.com

Any other person who is obliged to furnish the tax audit report. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. An income-tax return that filed after the due date is called Belated Return. The deadline change applies to the 2020 individual income tax returns previously due on April 15 2021 and any payments due on those returns. ITR applicable for income earned between April 1 2020 and March 31.

Source: taxfoundation.org

Source: taxfoundation.org

The Treasury Department and Internal Revenue Service announced on March 17 that the federal income tax filing and payment due date for individuals for the 2020 tax year will be automatically extended from April 15 2021 to May 17 2021. ITR applicable for income earned between April 1 2020 and March 31. The income tax return ITR filing deadline for FY 2020-21 December 31 2021 was not extended any further by the government. Rollover contributions and contributions generated from a rewards program are not eligible. 1131 ET Jan 4 2022.

Source: indianacitizen.org

Source: indianacitizen.org

It is important to note that the extension only shifts the filing deadline and not the payment deadline. It is filed under section 1394 of the income tax Act. The Indiana tax filing and tax payment deadline is April 18 2022. Any person who is subject to the transfer pricing provisions. Indiana has changed the individual income tax filing deadline to May 17 2021.

Source: en.wikipedia.org

Source: en.wikipedia.org

The due date of furnishing of Return of Income for the Assessment Year 2021-22 which is 30th November 2021 under sub-section 1 of section 139 of the Act as extended to 31st December 2021 vide Circular No92021 dated 20052021 is hereby further extended to 28th February 2022. The last tax year started on 6 April 2020 and ended on 5. HM Revenue and Customs HMRC must receive your tax return and any money you owe by the deadline. Maximum aggregate plan balance. It is filed under section 1394 of the income tax Act.

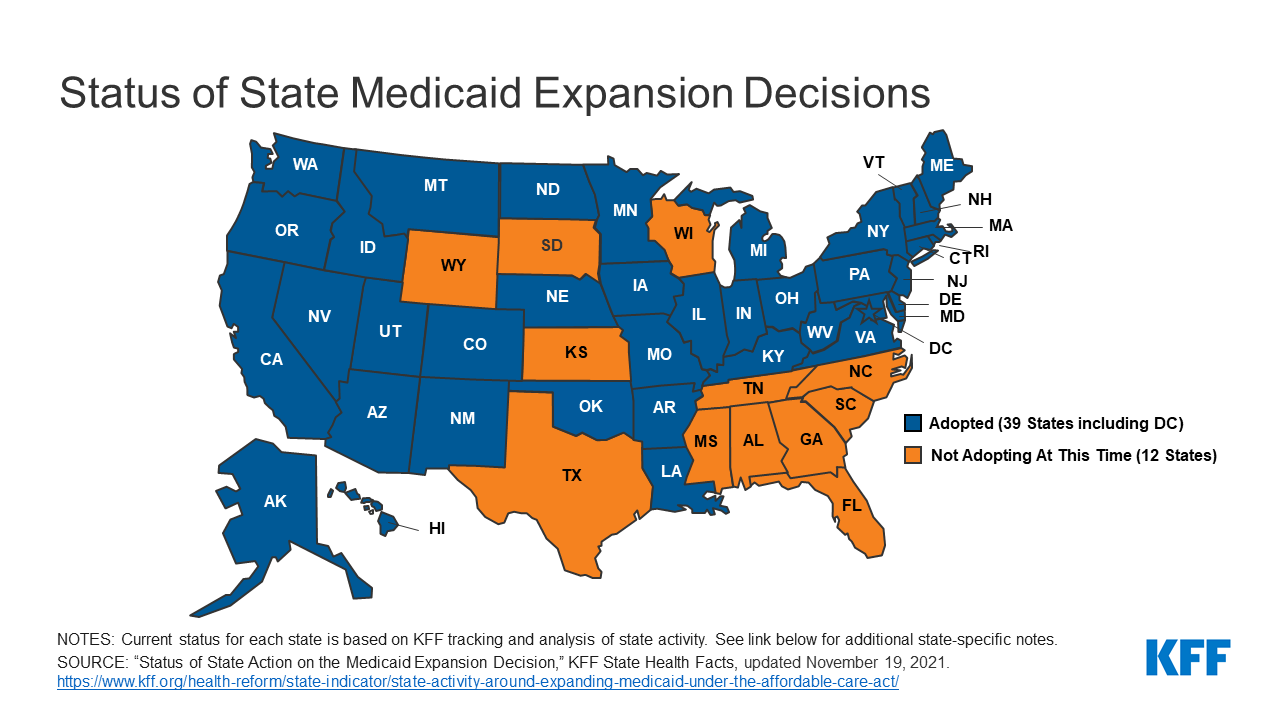

Source: kff.org

Source: kff.org

Tax returns for assessment year 2021-22 is. A timely filed extension moves the federal tax filing deadline to October 15 2021 and the Indiana filing deadline to November 15 2021. The last tax year started on 6 April 2020 and ended on 5. Rollover contributions and contributions generated from a rewards program are not eligible. MILLIONS of Americans in one state will be getting an automatic refund after they file their taxes for 2021.

Source: pnas.org

Source: pnas.org

Check the new Income Tax filing deadlines for FY 2020-21 AY 2021-22. It is important to note that the extension only shifts the filing deadline and not the payment deadline. What should taxpayers know about the new dates. Indiana filing and tax deadline dates for 2021 returns. Even though the ITR filing deadline was extended twice for the financial year many were not able to complete the exercise on time due to many glitches on the newly launched e-filing portal.

Source: hrblock.com

Source: hrblock.com

Maximum aggregate plan balance. Your ITR filing document checklist for FY20-21 Autoplay 1 of 10. Indiana filing and tax deadline dates for 2021 returns. The Treasury Department and Internal Revenue Service announced on March 17 that the federal income tax filing and payment due date for individuals for the 2020 tax year will be automatically extended from April 15 2021 to May 17 2021. The Indiana tax filing and tax payment deadline is April 18 2022.

A timely filed extension moves the federal tax filing deadline to October 15 2021 and the Indiana filing deadline to November 15 2021. Indiana Fiduciary Income Tax Return Unless you file on a fiscal year basis. MILLIONS of Americans in one state will be getting an automatic refund after they file their taxes for 2021. The Indiana tax filing and tax payment deadline is April 18 2022. What should taxpayers know about the new dates.

Source: whu.edu

Simplify Indiana sales tax compliance. The payment deadline is also April 18 2022. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to complete and file only an IN state return. The Treasury Department and Internal Revenue Service announced on March 17 that the federal income tax filing and payment due date for individuals for the 2020 tax year will be automatically extended from April 15 2021 to May 17 2021. Indiana has changed the individual income tax filing deadline to May 17 2021.

Source: smartasset.com

Source: smartasset.com

A timely filed extension moves the federal tax filing deadline to October 15 2021 and the Indiana filing deadline to November 15 2021. For retirement plans filing Federal form 990T the return must be filed by the 15 th day of the 5 th. What should taxpayers know about the new dates. The IT-41 Indiana Fiduciary Income Tax Return must then be filed by the 15 th day of the 4 th month following the close of the taxable year. Extension to Income Tax Filing Deadline 30 Sep 21 India has further extended its income tax deadlines for AY 2021-22.

The IT-41 Indiana Fiduciary Income Tax Return must then be filed by the 15 th day of the 4 th month following the close of the taxable year. It is important to note that the extension only shifts the filing deadline and not the payment deadline. Deadline for ITR filing was December 31 This years ITR will be filed for AY 2021-22 or FY 2020-21. It is important to note that the extension only shifts the filing deadline and not the payment deadline. The Treasury Department and Internal Revenue Service announced on March 17 that the federal income tax filing and payment due date for individuals for the 2020 tax year will be automatically extended from April 15 2021 to May 17 2021.

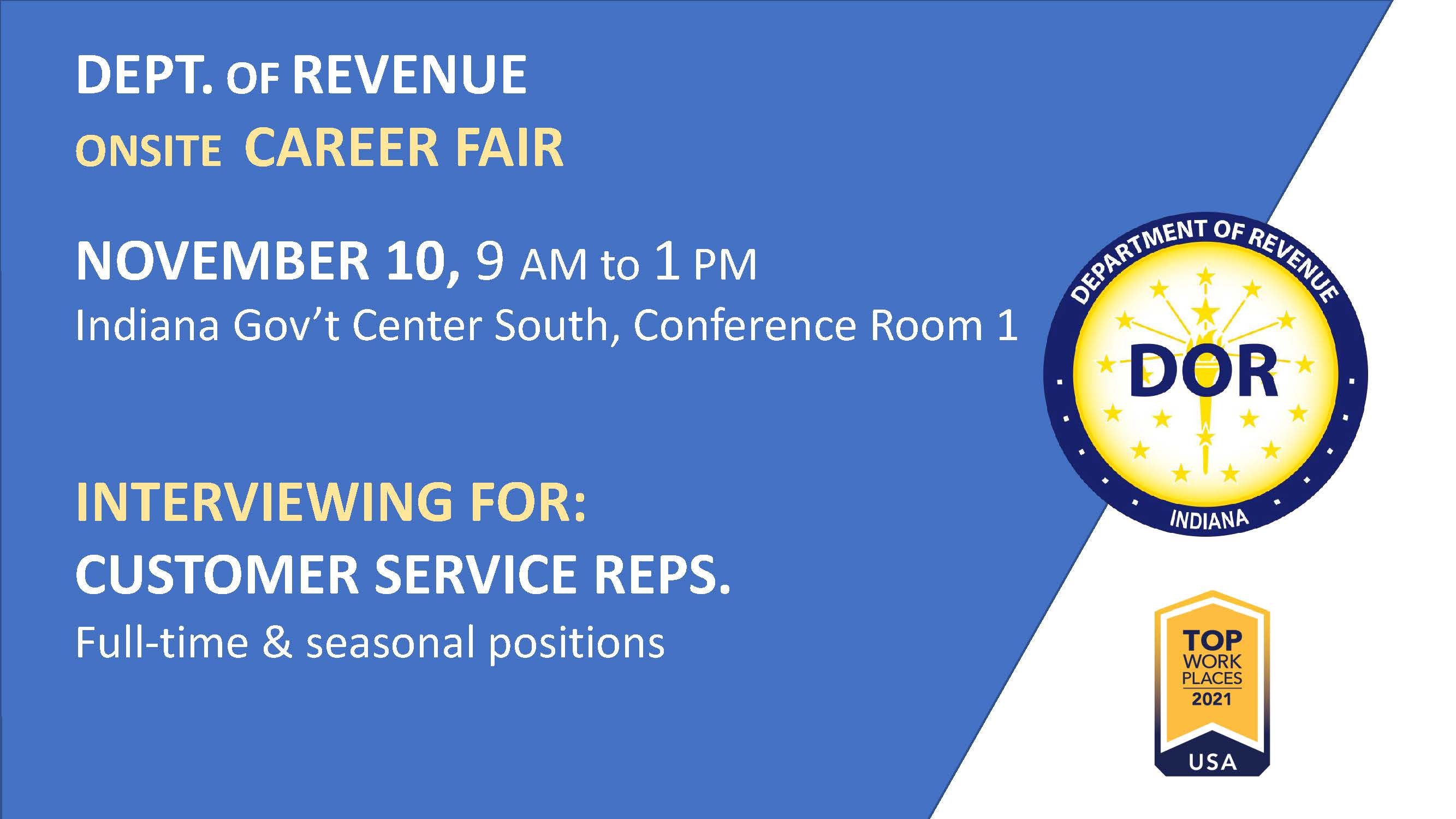

Source: international.iupui.edu

Source: international.iupui.edu

Maximum aggregate plan balance. Indiana residents will receive the checks worth 125 automatically once the funding in the. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. Rollover contributions and contributions generated from a rewards program are not eligible. Any person who is subject to the transfer pricing provisions.

Source: smartasset.com

Source: smartasset.com

The deadline change applies to the 2020 individual income tax returns previously due on April 15 2021 and any payments due on those returns. Indiana has changed the individual income tax filing deadline to May 17 2021. IRS and Indiana DOR Extend Tax Filing Deadline to May 17 2021 March 26 2021. Deadline for ITR filing was December 31 This years ITR will be filed for AY 2021-22 or FY 2020-21. Indiana Fiduciary Income Tax Return Unless you file on a fiscal year basis.

Source: smartasset.com

Source: smartasset.com

Indiana State Income Taxes for Tax Year 2021 January 1 - Dec. DOR Provides Additional Important Information on Unemployment Income. It is filed under section 1394 of the income tax Act. Indiana Fiduciary Income Tax Return Unless you file on a fiscal year basis. Your ITR filing document checklist for FY20-21 Autoplay 1 of 10.

Source: ktla.com

Source: ktla.com

1019 ET Jan 6 2022. A timely filed extension moves the federal tax filing deadline to October 15 2021 and the Indiana filing deadline to November 15 2021 Indiana DOR explained in announcing the extension. Income Tax Return Latest Update. HM Revenue and Customs HMRC must receive your tax return and any money you owe by the deadline. Indiana Fiduciary Income Tax Return Unless you file on a fiscal year basis.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is the tax deadline for 2021 in indiana by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.