Your When can you file taxes 2021 massachusetts images are ready in this website. When can you file taxes 2021 massachusetts are a topic that is being searched for and liked by netizens today. You can Download the When can you file taxes 2021 massachusetts files here. Get all royalty-free images.

If you’re looking for when can you file taxes 2021 massachusetts pictures information connected with to the when can you file taxes 2021 massachusetts interest, you have visit the right site. Our site frequently provides you with suggestions for downloading the highest quality video and image content, please kindly surf and find more informative video articles and images that fit your interests.

When Can You File Taxes 2021 Massachusetts. PENNSYLVANIA USA Experts say that 2021 could be one of the most complicated years to file your taxes. If you dont receive your W-2 you should contact your employer. Accurate Generally there are fewer errors with electronic filings than paper forms. 15 to file their 2021 tax return but does not grant an extension of time to pay taxes due.

Can You Lose Stimulus Checks If You Don T File Taxes Before 2021 Deadline As Com From en.as.com

Can You Lose Stimulus Checks If You Don T File Taxes Before 2021 Deadline As Com From en.as.com

December 23 2021 Tax Filing Table of Contents show When is the First Day to Start Filing Taxes in 2022. The Internal Revenue Service will most likely set the opening day for the 2021 2022 filing season on or about Jan. My advice is to file between mid-February and the end of March to ensure you have all your tax forms and documentation in order. You wont get a payment in January but you can expect more enhanced child tax credit money to arrive this year. 15 to file their 2021 tax return but does not grant an extension of time to pay taxes due. Youll need to estimate and pay any owed taxes by the regular deadline to avoid penalties.

Due to winter storms the federal deadline for people.

That you dont miss anything important. The tax deadline to pay and e-File 2021 Taxes is April 18 2022. My advice is to file between mid-February and the end of March to ensure you have all your tax forms and documentation in order. We can do your taxes now and when you file at Block you could get a Refund Advance 109 up to 3500 today. The special income sourcing rules. Taxpayers should pay their.

Source: money.com

Source: money.com

The federal estate tax has a much higher exemption level than the Massachusetts estate tax. Terms and conditions may vary and are subject to change without notice. Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024. Accurate Generally there are fewer errors with electronic filings than paper forms. Employers banks and investment firms have until the end of January to send you records such as W-2 forms and 1099-DIV statements.

Source: gtm.com

Source: gtm.com

2020 Tax Return Dates Filed in 2021. Individual and corporate tax returns must be filed for the 2020 tax year by April 15 2021. You dont have to file as you wont have any penalties for failure to file or delinquent taxes since you wouldnt owe any money the CTC payments are non-taxable and do not count as income towards any other benefits. If you file your taxes before receiving all your employment and income statements you will have to file an amended return. 15 to file their 2021 tax return but does not grant an extension of time to pay taxes due.

Source: smartasset.com

Source: smartasset.com

Due to winter storms the federal deadline for people. The IRS defines gross income as all income you receive in. If your 2021 gross income exceeds the amount shown in the table above you must file a federal income tax return. 15 to file their 2021 tax return but does not grant an extension of time to pay taxes due. If you miss this date you have until October 15 2022.

Source: lendingkart.com

Source: lendingkart.com

Employers banks and investment firms have until the end of January to send you records such as W-2 forms and 1099-DIV statements. Individual and corporate tax returns must be filed for the 2020 tax year by April 15 2021. First Day to File Taxes 2021. However this year you have until April 18 2022 to file a 2021 Form 1040 or Form 1040-SR and pay any tax due according to the drafted IRS 2021 tax year instructions. You wont get a payment in January but you can expect more enhanced child tax credit money to arrive this year.

Source: myexpattaxes.com

Source: myexpattaxes.com

If you opted out of receiving payments before. Accurate Generally there are fewer errors with electronic filings than paper forms. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. Faster processing of your refund and money in your account sooner. You wont get a payment in January but you can expect more enhanced child tax credit money to arrive this year.

Source: mnetax.com

Source: mnetax.com

If your 2021 gross income exceeds the amount shown in the table above you must file a federal income tax return. 734 PM EST January 2 2022. The federal estate tax has a much higher exemption level than the Massachusetts estate tax. Due to winter storms the federal deadline for people. The IRS defines gross income as all income you receive in.

Source: cnet.com

Source: cnet.com

My advice is to file between mid-February and the end of March to ensure you have all your tax forms and documentation in order. My advice is to file between mid-February and the end of March to ensure you have all your tax forms and documentation in order. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. Employers must withhold Massachusetts tax on any wage income that is subject to the Massachusetts personal income tax whether the employee is a resident or a non-resident of Massachusetts. This means that with the right legal steps a married couple can protect up to 2412 million.

Source: en.as.com

Source: en.as.com

Faster processing of your refund and money in your account sooner. If you file your taxes before receiving all your employment and income statements you will have to file an amended return. No waiting on the IRS. First Day to File Taxes 2021. The IRS filing deadline was extended last year due to the pandemic emergency but the April 15 deadline holds this year.

Source: taxfoundation.org

Source: taxfoundation.org

If your 2021 gross income exceeds the amount shown in the table above you must file a federal income tax return. Individual and corporate tax returns must be filed for the 2020 tax year by April 15 2021. The Internal Revenue Service will most likely set the opening day for the 2021 2022 filing season on or about Jan. December 23 2021 Tax Filing Table of Contents show When is the First Day to Start Filing Taxes in 2022. There are special rules for wages or other compensation paid to employees who are working remotely due to the COVID-19 Pandemic.

Source: 6abc.com

Source: 6abc.com

31 2021 can be completed and e-Filed now with a Federal Income Tax Return or you can learn how to only prepare and file a MA state return. Taxpayers should pay their. If you need more time you can apply for a tax extension but remember that doesnt grant you any extension of time to pay your taxes. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. The Internal Revenue Service will most likely set the opening day for the 2021 2022 filing season on or about Jan.

Source: blog.taxact.com

Source: blog.taxact.com

Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024. 734 PM EST January 2 2022. Fast Filing electronically rather than on paper can mean much. Y ou have until April 18 2022 to e-File a MA Income Tax Return. You dont have to file as you wont have any penalties for failure to file or delinquent taxes since you wouldnt owe any money the CTC payments are non-taxable and do not count as income towards any other benefits.

Source: blog.turbotax.intuit.com

Source: blog.turbotax.intuit.com

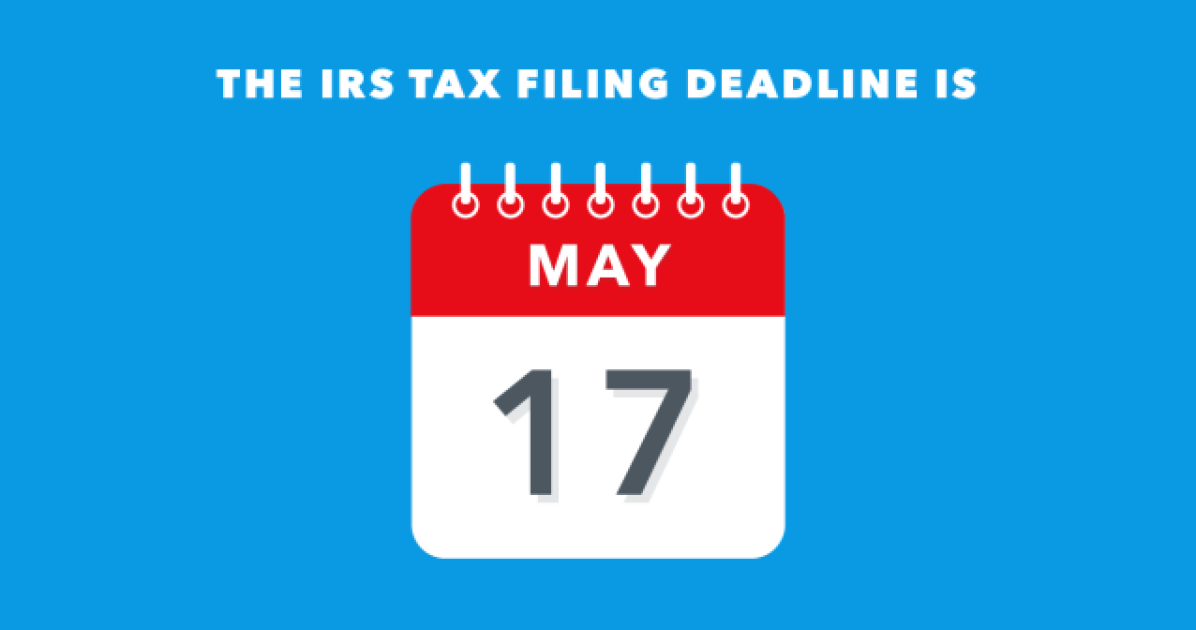

Keep in mind if you owe taxes and. If you opted out of receiving payments before. Unlike the Massachusetts estate tax exemption the federal exemption is portable between spouses. If you dont receive your W-2 you should contact your employer. Tax returns and payments for 2020 are now due on May 17 2021.

Source: aarp.org

Source: aarp.org

However this year you have until April 18 2022 to file a 2021 Form 1040 or Form 1040-SR and pay any tax due according to the drafted IRS 2021 tax year instructions. Online programs make it easy to ensure. The federal tax deadline is automatically extended for individuals this year. If you file your taxes before receiving all your employment and income statements you will have to file an amended return. If you dont receive your W-2 you should contact your employer.

Source: pinterest.com

Source: pinterest.com

Faster processing of your refund and money in your account sooner. Unlike the Massachusetts estate tax exemption the federal exemption is portable between spouses. Typically the official date when you can file taxes falls in mid to late January. 15 to file their 2021 tax return but does not grant an extension of time to pay taxes due. Tax returns and payments for 2020 are now due on May 17 2021.

Source: forbes.com

Source: forbes.com

When you file your 2021 taxes. Massachusetts State Income Taxes for Tax Year 2021 January 1 - Dec. This means that with the right legal steps a married couple can protect up to 2412 million. The tax deadline to pay and e-File 2021 Taxes is April 18 2022. 31 2021 can be completed and e-Filed now with a Federal Income Tax Return or you can learn how to only prepare and file a MA state return.

Source: fox8.com

Source: fox8.com

Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024. The Internal Revenue Service will most likely set the opening day for the 2021 2022 filing season on or about Jan. No waiting on the IRS. If you file your taxes before receiving all your employment and income statements you will have to file an amended return. The IRS announced it will start processing tax returns Feb.

Source: smartasset.com

Source: smartasset.com

The tax deadline to pay and e-File 2021 Taxes is April 18 2022. The federal tax deadline is automatically extended for individuals this year. Typically the official date when you can file taxes falls in mid to late January. Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024. If your 2021 gross income exceeds the amount shown in the table above you must file a federal income tax return.

Source: nytimes.com

Source: nytimes.com

If you file your taxes before receiving all your employment and income statements you will have to file an amended return. PENNSYLVANIA USA Experts say that 2021 could be one of the most complicated years to file your taxes. If you miss this date you have until October 15 2022. After 11302022 TurboTax Live Full. You have until approximately Tuesday April 15 to file your 2021 returns.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title when can you file taxes 2021 massachusetts by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.