Your When can you file taxes 2021 south africa images are available in this site. When can you file taxes 2021 south africa are a topic that is being searched for and liked by netizens today. You can Get the When can you file taxes 2021 south africa files here. Download all free photos and vectors.

If you’re looking for when can you file taxes 2021 south africa images information linked to the when can you file taxes 2021 south africa topic, you have pay a visit to the ideal blog. Our site always provides you with suggestions for seeking the highest quality video and image content, please kindly hunt and find more informative video articles and graphics that match your interests.

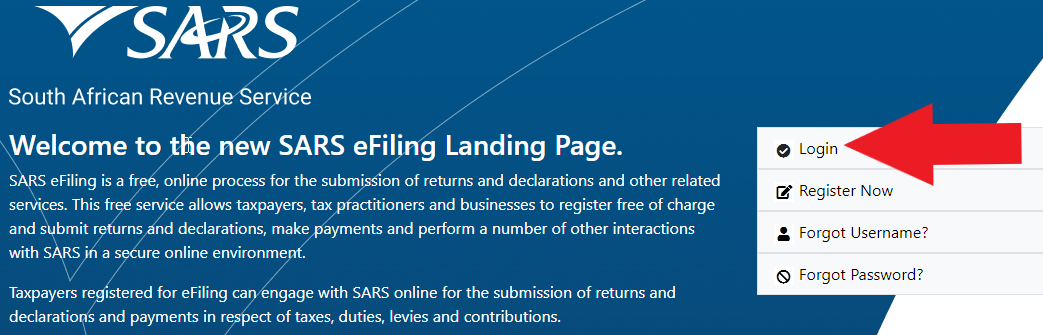

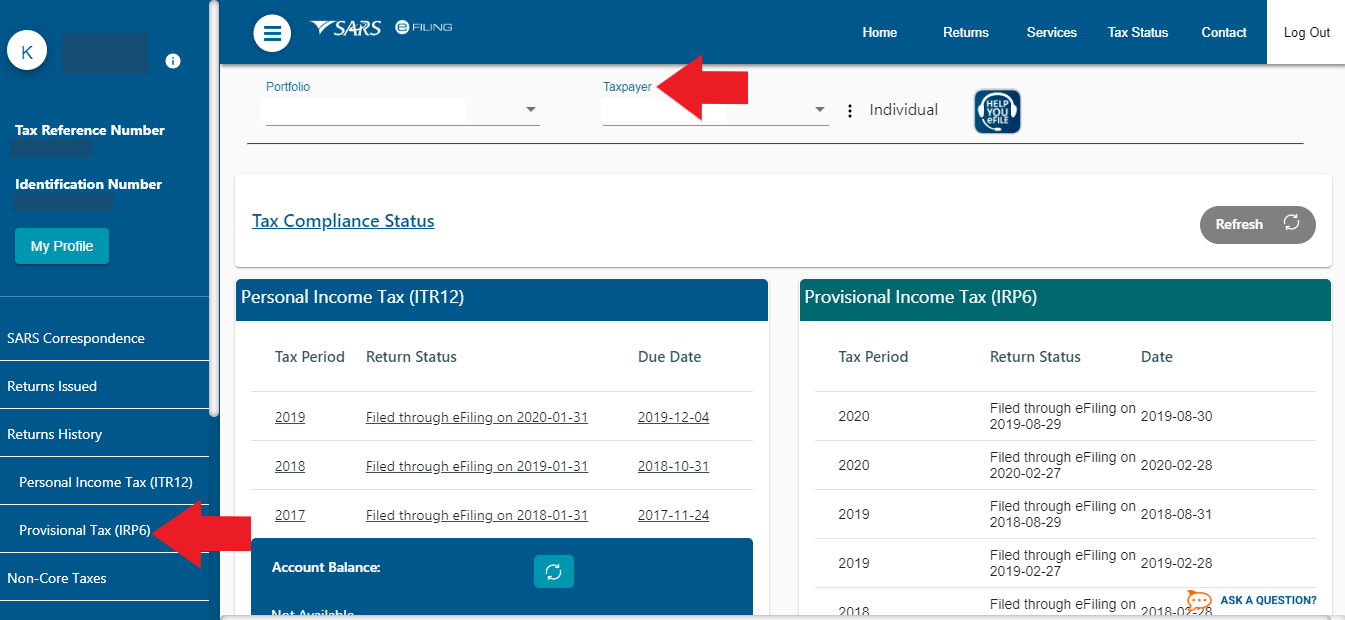

When Can You File Taxes 2021 South Africa. How to file your income tax return in South Africa Residents who pay taxes in South Africa have to fill in an annual tax return form and submit it to SARS. 1 July to 23 November 2021 for non-provisional taxpayers filing online. You can either apply as a provisional taxpayer when you first register for a tax number with SARS or make the change on your SARS eFiling profile by going to the Home Tab and clicking Tax Types and registering there. Tax filing season always begins in September after the tax year finishes 2022 Mar 2021 - Feb 2022 2021 Mar 2020 - Feb 2021 2020 Mar 2019 - Feb 2020 Did you work for an employer or receive an annuity from a fund.

South Africans Working And Living Abroad Are Preparing Themselves For The New Amendments To The Income Tax Act Which Are Tax Deadline Tax Return Filing Taxes From pinterest.com

South Africans Working And Living Abroad Are Preparing Themselves For The New Amendments To The Income Tax Act Which Are Tax Deadline Tax Return Filing Taxes From pinterest.com

Is exempt provided the person spends more than 183 days 2020 and 2021 tax years. 117 days of which at least 60 days is continuous outside South Africa in any 12 month period commencing or ending during that tax year. When Can I File My 2021 Taxes in 2022 and Other Key IRS Tax Return Filing Deadlines Extensions and Due Dates. How to file your income tax return in South Africa Residents who pay taxes in South Africa have to fill in an annual tax return form and submit it to SARS. Given the number of government payments to reconcile in. Did you conduct any trade in South Africa.

If you earn under R350 000 for a full year from one employer total salary income before tax and have no other sources of additional income for example interest or rental income and no deductions that you want to claim for example medical expenses travel or retirement annuities then you dont need to submit a return.

Prior to 1 March 2020 foreign employment income was fully exempt provided the same days requirement was met. 1 July to 23 November 2021 for non-provisional taxpayers filing online. Is exempt provided the person spends more than 183 days 2020 and 2021 tax years. SARS Tax Year 2021. SARS apologises for any inconvenience caused. The tables below shows key dates and events for filing federal tax returns with the IRS andor requesting temporary extensions.

Source: pinterest.com

Source: pinterest.com

You can either apply as a provisional taxpayer when you first register for a tax number with SARS or make the change on your SARS eFiling profile by going to the Home Tab and clicking Tax Types and registering there. See the Tax Tables. Do any of the following apply to you for the tax year 1 March 2020 to 29 February 2021. The tables below shows key dates and events for filing federal tax returns with the IRS andor requesting temporary extensions. If you are a South African tax resident did you conduct any trade or employment outside South Africa.

Source: youtube.com

Source: youtube.com

If you are a South African tax resident did you conduct any trade or employment outside South Africa. Therefore you pay a higher income tax rate the more you earn. 16 July 2021 Companies can file their ITR14 tax returns. Is exempt provided the person spends more than 183 days 2020 and 2021 tax years. The South African tax year runs from 1 March to 2829 February.

Source: pinterest.com

Source: pinterest.com

Interest earned of R23 800 by an individual below the age of 65 years. 1 July to 23 November 2021 for non-provisional taxpayers filing online. Employers are required to submit their Employer Reconciliation Declaration EMP501 to SARS by 31 May as well as outstanding monthly. The income tax brackets in South Africa for the 2021 tax year 1 March 2020 to 28 February 2021 are as follows. Prior to 1 March 2020 foreign employment income was fully exempt provided the same days requirement was met.

Source: taxtim.com

Source: taxtim.com

Interest earned of R23 800 by an individual below the age of 65 years. Did you conduct any trade in South Africa. Filing season for employers runs from 1 April to 31 May 2021. The income tax brackets in South Africa for the 2021 tax year 1 March 2020 to 28 February 2021 are as follows. A simple tax return for salary andor medical aid retirement investments capital gains andor home office.

Source: pinterest.com

Source: pinterest.com

When Can I File My 2021 Taxes in 2022 and Other Key IRS Tax Return Filing Deadlines Extensions and Due Dates. The eFiling pop up message for the filing of the Income Tax Return for companies ITR14 for the 2021 year of assessment that intend to deregister with CIPC ONLY has been removed. The tax season when people submit their tax return forms is from July to November depending on the filing method. Pay R356 for your first tax return paid upfront after registering. SARS apologises for any inconvenience caused.

Source: greenbacktaxservices.com

Source: greenbacktaxservices.com

Tax filing season for individuals will still start on 1 July 2021. NO medical aid retirement allowances or other income. Even though taxes for most taxpayers are due by April 15 2021 you can e-file electronically file your. See the Tax Tables. 117 days of which at least 60 days is continuous outside South Africa in any 12 month period commencing or ending during that tax year.

Source: pinterest.com

Source: pinterest.com

Income tax brackets in South Africa are progressive. Income tax brackets in South Africa are progressive. 16 July 2021 Companies can file their ITR14 tax returns. When Can I File Taxes in 2021. Given the number of government payments to reconcile in.

Source: greenbacktaxservices.com

Source: greenbacktaxservices.com

When should I submit VAT returns and make payments. Tax filing season for individuals will still start on 1 July 2021. SARS Tax Year 2021. Every year SARS announces its Tax Season a period during which you are required to submit your annual income tax return. When Can I File Taxes in 2021.

Source: sars.gov.za

Source: sars.gov.za

Even though taxes for most taxpayers are due by April 15 2021 you can e-file electronically file your. The South African Revenue Services SARS 2019 tax season for non-provisional individual taxpayers officially started on 1 August 2019 with those filing via eFiling and SARS MobiApp being able to do so from 1 July 2019. 117 days of which at least 60 days is continuous outside South Africa in any 12 month period commencing or ending during that tax year. Tax filing season for individuals will still start on 1 July 2021. Alternatively you can visit your nearest SARS branch in person or call the call centre on 0800 00 7277 0800 00 SARS.

Source: taxtim.com

Source: taxtim.com

The income tax brackets in South Africa for the 2021 tax year 1 March 2020 to 28 February 2021 are as follows. Branch filing closes on 31 October 2019 and eFiling or MobiApp filing closes on 4 December 2019. R 83 100 you need to register for Provisional Tax. 1 July to 31 January 2022 for provisional taxpayers and trusts filing online via eFiling or the SARS MobiApp. SARS apologises for any inconvenience caused.

Source: johnnyafrica.com

Source: johnnyafrica.com

Branch filing closes on 31 October 2019 and eFiling or MobiApp filing closes on 4 December 2019. 117 days of which at least 60 days is continuous outside South Africa in any 12 month period commencing or ending during that tax year. Given the number of government payments to reconcile in. Did you earn interest exceeding the annual exempt amount. Even though taxes for most taxpayers are due by April 15 2021 you can e-file electronically file your.

Source: pinterest.com

Source: pinterest.com

The tables below shows key dates and events for filing federal tax returns with the IRS andor requesting temporary extensions. See the Tax Tables. You will also need to register if you are employed ie. When Can I File Taxes in 2021. Given the number of government payments to reconcile in.

Source: greenbacktaxservices.com

Source: greenbacktaxservices.com

Do any of the following apply to you for the tax year 1 March 2020 to 29 February 2021. When Can I File My 2021 Taxes in 2022 and Other Key IRS Tax Return Filing Deadlines Extensions and Due Dates. A company must submit its ITR14 tax return within 12 months of its. Pay R356 for your first tax return paid upfront after registering. The income tax brackets in South Africa for the 2021 tax year 1 March 2020 to 28 February 2021 are as follows.

Source: pinterest.com

Source: pinterest.com

You will also need to register if you are employed ie. The Tax Season for 2021 opened on 1 July 2021. 117 days of which at least 60 days is continuous outside South Africa in any 12 month period commencing or ending during that tax year. A simple tax return for salary andor medical aid retirement investments capital gains andor home office. The South African Revenue Services SARS 2019 tax season for non-provisional individual taxpayers officially started on 1 August 2019 with those filing via eFiling and SARS MobiApp being able to do so from 1 July 2019.

Source: taxtim.com

Source: taxtim.com

When Can I File Taxes in 2021. SARS apologises for any inconvenience caused. Therefore you pay a higher income tax rate the more you earn. Income tax brackets in South Africa are progressive. Tax filing season always begins in September after the tax year finishes 2022 Mar 2021 - Feb 2022 2021 Mar 2020 - Feb 2021 2020 Mar 2019 - Feb 2020 Did you work for an employer or receive an annuity from a fund.

Source: pinterest.com

Source: pinterest.com

A simple tax return for salary andor medical aid retirement investments capital gains andor home office. Employers are required to submit their Employer Reconciliation Declaration EMP501 to SARS by 31 May as well as outstanding monthly. If you earn under R350 000 for a full year from one employer total salary income before tax and have no other sources of additional income for example interest or rental income and no deductions that you want to claim for example medical expenses travel or retirement annuities then you dont need to submit a return. Did you conduct any trade in South Africa. Did you earn interest exceeding the annual exempt amount.

Source: sars.gov.za

Source: sars.gov.za

If you are self-employed and earn taxable income above the tax threshold which is R 87 300 for the 2022 tax year 2021. The Tax Season for 2021 opened on 1 July 2021. The South African tax year runs from 1 March to 2829 February. The tax season when people submit their tax return forms is from July to November depending on the filing method. Did you conduct any trade in South Africa.

Source: expatica.com

Source: expatica.com

A vendor is required to submit VAT returns and make payments of the VAT liabilities or claim a VAT refund on or before the 25 th day or the last business day of the month following the month in which the vendors tax. 117 days of which at least 60 days is continuous outside South Africa in any 12 month period commencing or ending during that tax year. When Can I File Taxes in 2021. If you are a South African tax resident did you conduct any trade or employment outside South Africa. Did you earn interest exceeding the annual exempt amount.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title when can you file taxes 2021 south africa by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.