Your When to file taxes 2021 uk images are available. When to file taxes 2021 uk are a topic that is being searched for and liked by netizens today. You can Find and Download the When to file taxes 2021 uk files here. Download all royalty-free images.

If you’re looking for when to file taxes 2021 uk images information related to the when to file taxes 2021 uk keyword, you have visit the right site. Our website always gives you suggestions for seeing the highest quality video and picture content, please kindly surf and find more enlightening video articles and images that fit your interests.

When To File Taxes 2021 Uk. MTD for ITSA - working with landlord clients. When it comes to your taxes there are likely more free filing options than you may realize. This was mainly because a major new law passed in late 2020 which included changes to the tax law and 600 stimulus checks. Also the deadline for claiming tax overpaid for the 201617 tax year under self-assessment.

Pin On Building From pinterest.com

Pin On Building From pinterest.com

Midnight 31 January 2022. 5 April 2021 Last day of 202021 tax year. Three options to file your tax return for free. As a filing single or married filing separate person if your 2021 income did not not equal or exceed the standard deduction limit of 12550 and you do not owe any special taxes or have any special tax situations that require you to file you do not need to file. Both individual and corporate tax returns for the 2020 fiscal year must be filed by April 15 2021. Tax preparation software including IRS Free File will help taxpayers figure the amount.

Is it possible to submit 2021 before 5 April.

Qualifying taxpayers can save money by using one of a handful of free services. Individual and corporate tax returns must be filed for the 2020 tax year by April 15 2021. Last day to file an original or amended tax return from 2017 and claim a rebate unless you have an extension then this is October 15 2021. New rules introduced in January 2021 mean if you import or order items online from outside the UK and the total does not exceed 135 you pay VAT at the point of sale. The May 16 deadline also applies to quarterly estimated income tax payments due on January 18 and April 18. Qualifying taxpayers can save money by using one of a handful of free services.

Source: pinterest.com

Source: pinterest.com

When it comes to your taxes there are likely more free filing options than you may realize. Midnight 31 October 2021. When it comes to your taxes there are likely more free filing options than you may realize. The tax strategy must include all prescribed information and must be published in an internet. Making Tax Digital - VAT developments.

Source: pinterest.com

Source: pinterest.com

But you can file your tax return at any time before then there are a number of benefits in filing it early. As a filing single or married filing separate person if your 2021 income did not not equal or exceed the standard deduction limit of 12550 and you do not owe any special taxes or have any special tax situations that require you to file you do not need to file. The tax strategy must include all prescribed information and must be published in an internet. 22nd Jun 2020 1144. But you can file your tax return at any time before then there are a number of benefits in filing it early.

Source: expatica.com

Source: expatica.com

Both individual and corporate tax returns for the 2020 fiscal year must be filed by April 15 2021. If you submit a paper tax return you need to. Self Assessment deadline for income earned in 2020-21. Tax return deadlines and penalties If you. 31 May 2020 Copies of 201920 P60 documents issued to employees.

Source: taxback.com

Source: taxback.com

This was mainly because a major new law passed in late 2020 which included changes to the tax law and 600 stimulus checks. New rules introduced in January 2021 mean if you import or order items online from outside the UK and the total does not exceed 135 you pay VAT at the point of sale. Is it possible to submit 2021 before 5 April. Making Tax Digital - VAT developments. 31 January 2021 Deadline to file your UK self-assessment tax return for 201920 and to pay any remaining balance of tax owed for the same tax year.

Source: riftrefunds.co.uk

Source: riftrefunds.co.uk

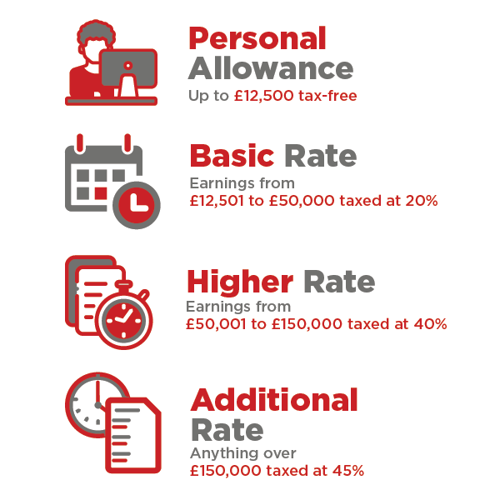

Tax preparation software including IRS Free File will help taxpayers figure the amount. Income tax in the UK is calculated according to a series of bands. So if we are talking about the tax year 20212022 it would start on 6 April 2021 and finish on 5 April 2022. 5 April 2021 Last day of 202021 tax year. Also the deadline for claiming tax overpaid for the 201617 tax year under self-assessment.

Source:

Source:

Here we outline the key dates for the 20202021 tax year. 5 April 2021 Last day of 202021 tax year. Both individual and corporate tax returns for the 2020 fiscal year must be filed by April 15 2021. Individual and corporate tax returns must be filed for the 2020 tax year by April 15 2021. Qualifying taxpayers can save money by using one of a handful of free services.

Source: pinterest.com

Source: pinterest.com

The tax strategy must include all prescribed information and must be published in an internet. The very basic and general answer is this. But you can file your tax return at any time before then there are a number of benefits in filing it early. Tax return deadlines and penalties If you. Midnight 31 October 2021.

Source: expatica.com

Source: expatica.com

5 April 2020 End of the last tax year and deadline for claiming your PAYE tax refund for the 201516 tax year. Midnight 31 January 2022. Remember advance stimulus payments received separately are not taxable and they do not reduce the taxpayers refund when they file in 2021. For untaxed income earned during the 2020-21 tax year the online deadline for filing your Self Assessment tax return and paying your bill is midnight 31 January 2022. When it comes to your taxes there are likely more free filing options than you may realize.

Source: raisin.co.uk

Source: raisin.co.uk

Income tax in the UK is calculated according to a series of bands. Want to fill in a paper tax return you must send it to us by 31 October 2021 or 3 months after the date on your notice to complete a tax return if. Three options to file your tax return for free. 5 April 2020 End of the last tax year and deadline for claiming your PAYE tax refund for the 201516 tax year. The filing deadline for 2019 returns was extended from April to July 15 2020 because of the coronavirus.

Source: pinterest.com

Source: pinterest.com

As a filing single or married filing separate person if your 2021 income did not not equal or exceed the standard deduction limit of 12550 and you do not owe any special taxes or have any special tax situations that require you to file you do not need to file. WITH the 2021 tax season right around the corner its time to start considering how and when youll file your 2021 taxes. As of now you should have your tax return filed by April 15 2022. The deadline to file your 2020 to 2021 tax return online and pay any tax you owe is 31 January 2022. Deadline for the 1 st payment on account for 202021 tax year.

Source: pinterest.com

Source: pinterest.com

When it comes to your taxes there are likely more free filing options than you may realize. When it comes to your taxes there are likely more free filing options than you may realize. Key filing season dates There are several important dates taxpayers should keep in mind for this years filing season. These may also be applicable to goods that you bring to the UK from abroad if you exceed the limits. Want to fill in a paper tax return you must send it to us by 31 October 2021 or 3 months after the date on your notice to complete a tax return if.

Source: pinterest.com

Source: pinterest.com

As a filing single or married filing separate person if your 2021 income did not not equal or exceed the standard deduction limit of 12550 and you do not owe any special taxes or have any special tax situations that require you to file you do not need to file. As a filing single or married filing separate person if your 2021 income did not not equal or exceed the standard deduction limit of 12550 and you do not owe any special taxes or have any special tax situations that require you to file you do not need to file. Also the deadline for claiming tax overpaid for the 201617 tax year under self-assessment. 5 April 2021 Last day of 202021 tax year. Three options to file your tax return for free.

Source: pinterest.com

Source: pinterest.com

For untaxed income earned during the 2020-21 tax year the online deadline for filing your Self Assessment tax return and paying your bill is midnight 31 January 2022. The very basic and general answer is this. As a filing single or married filing separate person if your 2021 income did not not equal or exceed the standard deduction limit of 12550 and you do not owe any special taxes or have any special tax situations that require you to file you do not need to file. As cryptocurrencies like bitcoin have grown in popularity over the years so has the amount of people who are making money by investing or trading them. Last day to file an original or amended tax return from 2017 and claim a rebate unless you have an extension then this is October 15 2021.

Source: forbes.com

Source: forbes.com

Tax preparation software including IRS Free File will help taxpayers figure the amount. Midnight 31 October 2021. MTD for ITSA - working with landlord clients. For untaxed income earned during the 2020-21 tax year the online deadline for filing your Self Assessment tax return and paying your bill is midnight 31 January 2022. As of now you should have your tax return filed by April 15 2022.

Source: pinterest.com

Source: pinterest.com

When it comes to your taxes there are likely more free filing options than you may realize. The May 16 deadline also applies to quarterly estimated income tax payments due on January 18 and April 18. 22nd Jun 2020 1144. Pay the tax you owe. This deadline could get extended as it did in 2021 until May 17.

Source: taxscouts.com

Source: taxscouts.com

The head UK entity of a relevant large business with a 31 December 2021 accounting reference date should ensure that it has published the groups UK tax strategy by 31 December 2021 or if sooner within 15 months of the publication of its previous tax strategy. The 31 January during the tax year would be 31 January 2022 the 5 October following the end of the tax year would be 5 October 2022 and the 31 January following the end of the tax year would be 31. PAYE KEY TAX DATES. Midnight 31 October 2021. Tax return deadlines and penalties If you.

Source: pinterest.com

Source: pinterest.com

As a filing single or married filing separate person if your 2021 income did not not equal or exceed the standard deduction limit of 12550 and you do not owe any special taxes or have any special tax situations that require you to file you do not need to file. Also the deadline for claiming tax overpaid for the 201617 tax year under self-assessment. Midnight 31 January 2022. Want to fill in a paper tax return you must send it to us by 31 October 2021 or 3 months after the date on your notice to complete a tax return if. If you submit a paper tax return you need to.

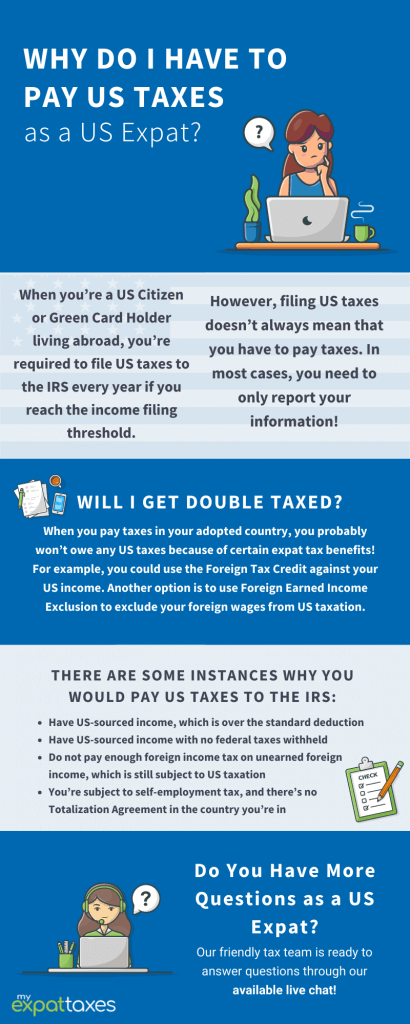

Source: myexpattaxes.com

Source: myexpattaxes.com

The tax strategy must include all prescribed information and must be published in an internet. In addition farmers who choose to forgo making estimated tax payments and normally file their returns by March 1 will now have until May 16 2022 to file their 2021 return and pay any tax due. The very basic and general answer is this. Last day to file an original or amended tax return from 2017 and claim a rebate unless you have an extension then this is October 15 2021. Both individual and corporate tax returns for the 2020 fiscal year must be filed by April 15 2021.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title when to file taxes 2021 uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.